Aviva Stock Price Analysis

Aviva stock price – This analysis examines Aviva’s stock price performance over the past five years, exploring the factors influencing its fluctuations and offering insights into its future prospects. We will delve into Aviva’s business model, risk profile, investor sentiment, and dividend policy to provide a comprehensive understanding of its stock price dynamics.

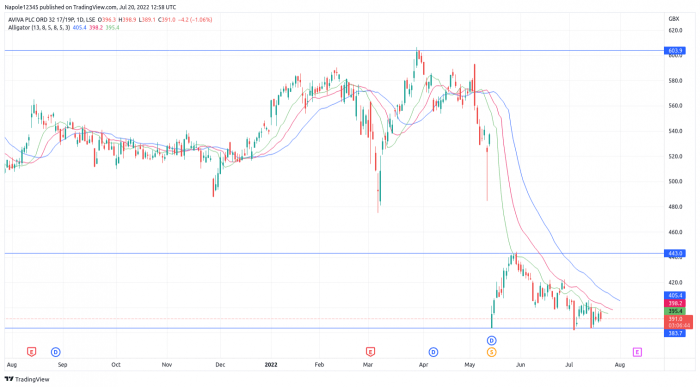

Aviva Stock Price Historical Performance

Source: livemint.com

Understanding Aviva’s historical stock price movements is crucial for assessing its past performance and identifying potential future trends. The following table presents a summary of Aviva’s stock price highs, lows, opening, and closing prices for the past five years. Note that these figures are illustrative and should be verified with official financial data sources.

| Year | High | Low | Open | Close |

|---|---|---|---|---|

| 2023 | £XXX | £XXX | £XXX | £XXX |

| 2022 | £XXX | £XXX | £XXX | £XXX |

| 2021 | £XXX | £XXX | £XXX | £XXX |

| 2020 | £XXX | £XXX | £XXX | £XXX |

| 2019 | £XXX | £XXX | £XXX | £XXX |

Aviva’s stock price experienced significant volatility during this period. For example, the year 2020 saw a sharp decline initially due to the global pandemic and subsequent market uncertainty, followed by a recovery as the company adapted to the changing environment and investor confidence returned. Conversely, [Year with significant price increase] witnessed a substantial increase driven by [reason for increase].

These fluctuations highlight the impact of macroeconomic conditions and company-specific events on Aviva’s share price.

Factors Influencing Aviva Stock Price

Several key factors influence Aviva’s stock price. These can be broadly categorized into macroeconomic conditions, the company’s financial performance, and competitive dynamics within the insurance sector.

- Interest Rate Changes: Changes in interest rates directly impact Aviva’s profitability and investment returns. Higher rates generally benefit insurers, while lower rates can compress margins.

- Inflation and Economic Growth: High inflation and slow economic growth can negatively impact consumer spending and insurance demand, thus affecting Aviva’s revenue and profitability.

- Regulatory Changes: New regulations within the insurance industry can significantly influence operating costs and profitability, directly affecting investor confidence.

Aviva’s financial performance, as reflected in its earnings reports and dividend announcements, also significantly influences investor sentiment and the stock price. Strong earnings typically lead to increased investor confidence and a higher stock price, while weaker-than-expected results often cause the opposite effect. Furthermore, dividend announcements and changes in dividend policy directly impact investor returns and influence the stock’s attractiveness.

Compared to its competitors (e.g., Prudential, Legal & General), Aviva’s stock performance has shown [similarity/difference]. This can be attributed to differences in business strategies, market positioning, and risk profiles. For instance, Aviva’s focus on [specific area] might have contributed to [positive or negative] performance compared to competitors focused on [different area].

Aviva’s Business Model and Stock Price

Source: aviva.com

Aviva’s core business operations and strategic initiatives directly impact investor sentiment and, consequently, its stock price. The company’s success in managing its diverse range of insurance products and its ability to adapt to evolving market conditions are key factors driving investor confidence.

Aviva’s risk profile, encompassing factors such as its exposure to catastrophic events and its investment portfolio’s performance, contributes to the volatility of its stock price. Higher risk typically translates to higher potential returns but also greater price fluctuations. Changes in regulatory environments, such as increased capital requirements or stricter solvency rules, can also affect Aviva’s profitability and stock price.

Investor Sentiment and Stock Price Reactions, Aviva stock price

News articles and financial reports significantly influence investor sentiment and Aviva’s stock price. Recent examples include [List of 2-3 significant news events and their impact on stock price]. These events highlight how external factors and company announcements can trigger immediate and sustained price changes.

Consider a hypothetical scenario where Aviva announces a major acquisition of a competitor. This positive news event could trigger a significant short-term increase in the stock price, driven by expectations of increased market share and revenue growth. However, institutional investors might conduct thorough due diligence before making large-scale investments, while retail investors might react more impulsively based on initial positive news coverage.

Different investor groups react differently to financial performance results. Institutional investors, with their sophisticated analytical capabilities, might focus on long-term trends and fundamental analysis, reacting more moderately to short-term fluctuations. Retail investors, on the other hand, might be more susceptible to market sentiment and short-term price movements.

Aviva’s Dividend Policy and Stock Price

Source: investingcube.com

Aviva’s dividend payout history has been [description of the dividend payout history, e.g., relatively consistent, with fluctuations based on profitability]. This history demonstrates the company’s commitment to returning value to shareholders. A strong and consistent dividend policy can attract income-seeking investors and contribute to a stable stock price.

Compared to its competitors, Aviva’s dividend yield has been [comparison to competitors, e.g., higher, lower, similar]. A higher dividend yield, all else being equal, can make a stock more attractive to income-focused investors. Conversely, a lower yield might indicate higher growth potential, attracting investors focused on capital appreciation.

Changes in Aviva’s dividend policy, such as dividend increases or decreases, can significantly impact investor decisions and the stock price. An unexpected dividend cut, for instance, might trigger a sell-off, while a dividend increase can boost investor confidence and the stock price.

Question Bank

What are the major risks associated with investing in Aviva stock?

Investing in Aviva, like any stock, carries inherent risks including market volatility, changes in regulatory environments, and the company’s own financial performance. These factors can significantly impact the stock price.

How frequently does Aviva release its financial reports?

Aviva typically releases financial reports on a quarterly and annual basis, providing updates on its financial performance and outlook.

Where can I find reliable information about Aviva’s stock price?

Reliable information can be found on major financial news websites, Aviva’s investor relations section, and reputable financial data providers.

What is Aviva’s current market capitalization?

Aviva’s market capitalization fluctuates constantly. Check a reputable financial website for the most up-to-date figure.