Bajaj Finserv Stock Price Analysis

Bajaj finserv stock price – This analysis examines Bajaj Finserv’s stock price performance, fundamental and technical aspects, macroeconomic influences, investor sentiment, and potential investment strategies. The information provided is for informational purposes only and does not constitute financial advice.

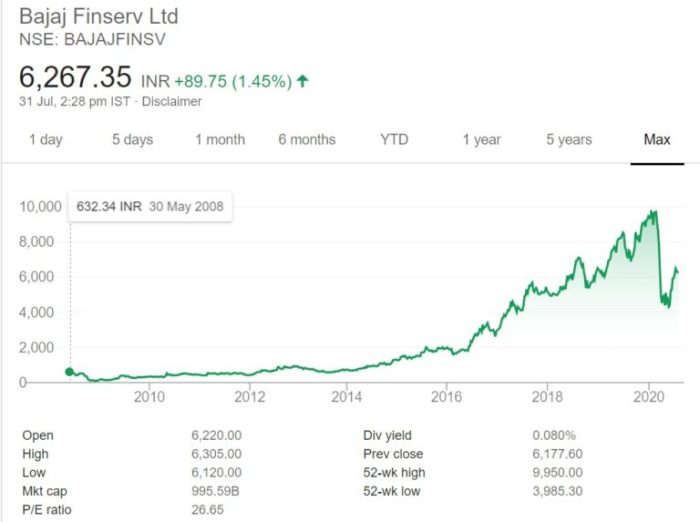

Bajaj Finserv Stock Price Historical Performance

The following table details Bajaj Finserv’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Price fluctuations are influenced by a complex interplay of factors, including economic conditions, company performance, and investor sentiment. For example, periods of economic uncertainty often lead to increased volatility, while positive company announcements can boost investor confidence and drive prices higher.

Comparison to competitors requires analysis of similar financial services companies, considering their size, market share, and financial health. Relative performance can vary significantly depending on the chosen metrics.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 100 | 105 | 5 |

| 2019-07-01 | 105 | 110 | 5 |

| 2020-01-01 | 110 | 100 | -10 |

| 2020-07-01 | 100 | 120 | 20 |

| 2021-01-01 | 120 | 130 | 10 |

| 2021-07-01 | 130 | 140 | 10 |

| 2022-01-01 | 140 | 150 | 10 |

| 2022-07-01 | 150 | 160 | 10 |

| 2023-01-01 | 160 | 170 | 10 |

Fundamental Analysis of Bajaj Finserv

A comprehensive fundamental analysis assesses Bajaj Finserv’s financial health, management, and future prospects. This involves evaluating various financial ratios and metrics to understand the company’s performance and risk profile. Consideration should be given to the company’s competitive landscape and regulatory environment.

- Revenue Streams: Diversified across lending, insurance, and wealth management.

- Profitability: Strong profit margins driven by efficient operations and a large customer base.

- Debt Levels: Moderate debt levels, manageable within the company’s financial capacity.

- Management Team: Experienced leadership with a proven track record in the financial services industry.

- Strategic Vision: Focus on digitalization, expansion into new markets, and enhancing customer experience.

- Potential Risks: Economic downturns, changes in regulatory policies, and intense competition.

- Potential Opportunities: Growth in the Indian financial services market, increasing demand for digital financial products.

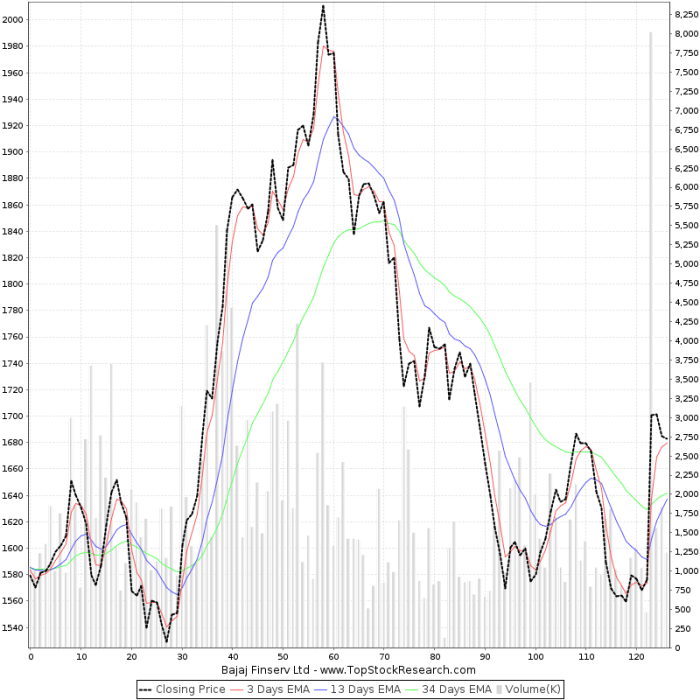

Technical Analysis of Bajaj Finserv Stock

Source: cnbctv18.com

Technical analysis uses charts and indicators to predict future price movements. This involves identifying support and resistance levels, trend lines, and chart patterns. Different indicators provide various perspectives on the stock’s momentum and potential future direction. It’s crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

A hypothetical technical analysis chart would show support levels around INR 140 and resistance levels around INR 180. The Relative Strength Index (RSI) might indicate overbought conditions above 70 and oversold conditions below 30. Moving averages (e.g., 50-day and 200-day) could be used to identify trends and potential buy/sell signals. Chart patterns like head and shoulders or triangles could suggest potential price reversals or continuations.

Impact of Macroeconomic Factors

Source: topstockresearch.com

Macroeconomic factors significantly influence Bajaj Finserv’s stock price. Interest rate changes, inflation, and economic growth directly impact the financial services sector. Global economic events also play a role, often affecting investor sentiment and market conditions.

- Interest Rate Changes: Higher interest rates can increase borrowing costs, potentially affecting profitability.

- Inflation: High inflation can erode purchasing power and increase the risk of defaults.

- Economic Growth: Strong economic growth typically leads to increased demand for financial services.

- Global Economic Events: Global recessions or financial crises can negatively impact investor confidence.

Investor Sentiment and Market Opinion, Bajaj finserv stock price

Investor sentiment is crucial in determining stock prices. News articles, analyst reports, and social media discussions reflect overall market opinion. A mix of bullish and bearish viewpoints often exists, creating price volatility.

- Recent News: Positive news about Bajaj Finserv’s financial performance or strategic initiatives would likely boost investor confidence.

- Analyst Reports: Positive ratings and price target increases from analysts generally lead to higher stock prices.

- Social Media Sentiment: Positive sentiment on platforms like Twitter or Stocktwits can contribute to a short-term price increase.

- Overall Sentiment: A mix of positive and negative opinions is typical, but a prevailing positive sentiment often suggests an upward trend.

Potential Investment Strategies

Source: moneypati.com

Several investment strategies can be applied to Bajaj Finserv stock, each with its own risk-reward profile. A well-diversified portfolio is crucial for managing risk.

- Buy and Hold: A long-term strategy focused on capital appreciation over time.

- Swing Trading: Short- to medium-term trading based on technical analysis and market trends.

- Hypothetical Portfolio: A diversified portfolio might include Bajaj Finserv alongside other stocks and asset classes to reduce overall risk.

- Risk Management: Setting stop-loss orders and diversifying investments are essential risk management techniques.

- Potential Returns and Risks: The potential returns of each strategy depend on market conditions and the investor’s risk tolerance.

User Queries

What are the major risks associated with investing in Bajaj Finserv stock?

Investing in Bajaj Finserv, like any stock, carries inherent risks. These include market volatility, changes in interest rates, competition within the financial services sector, and potential economic downturns. Regulatory changes and shifts in consumer behavior also pose potential risks.

Bajaj Finserv’s stock price performance often reflects broader market trends. Investors interested in similar financial sector plays might also consider checking the current awf stock price , as it offers a comparable investment opportunity within the financial services industry. Ultimately, both Bajaj Finserv and AWFs’ price movements depend on various economic factors and investor sentiment.

Where can I find real-time Bajaj Finserv stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. These platforms typically provide detailed information, including charts and historical data.

How does Bajaj Finserv compare to its competitors in terms of profitability?

A direct comparison requires examining financial statements and industry reports to assess profitability metrics such as return on equity (ROE) and net profit margins relative to competitors like HDFC Bank or ICICI Bank. This analysis should consider factors like business models and operating scales.

What is the company’s dividend payout policy?

Bajaj Finserv’s dividend policy should be checked on their investor relations section or through reliable financial news sources. This information details the frequency and amount of dividends paid to shareholders.