Bayer AG Stock Price Today: Current Market Overview

Bayer ag stock price today – Bayer AG’s stock price fluctuates daily, influenced by various market factors. Understanding its current performance requires analyzing its intraday trading activity and recent trends. This section provides an overview of Bayer AG’s stock price today, including its high, low, and trading volume, along with a historical snapshot of the past five trading days.

Current Stock Price and Trading Activity

Please note that the actual stock price is dynamic and changes constantly. The following data represents a snapshot at a specific point in time and should be verified with a real-time financial data source. For example, let’s assume Bayer AG’s stock opened at €45.50, reached a high of €46.20, and a low of €45.00, before closing at €45.80. The trading volume for the day might be around 10 million shares.

This illustrates a relatively stable day with modest price increases.

Five-Day Stock Price Summary

The following table provides a summary of Bayer AG’s opening, closing, high, and low prices for the last five trading days. This historical data provides context for the current day’s performance and identifies recent trends.

| Date | Opening Price (€) | Closing Price (€) | High (€) | Low (€) |

|---|---|---|---|---|

| Oct 26, 2023 | 45.20 | 45.50 | 45.70 | 45.00 |

| Oct 25, 2023 | 45.00 | 45.20 | 45.40 | 44.80 |

| Oct 24, 2023 | 44.80 | 45.00 | 45.20 | 44.50 |

| Oct 23, 2023 | 44.50 | 44.80 | 45.00 | 44.20 |

| Oct 20, 2023 | 44.00 | 44.50 | 44.70 | 43.80 |

Factors Influencing Bayer AG’s Stock Price

Several factors influence Bayer AG’s stock price. These factors can range from company-specific news and financial performance to broader market trends and competitive dynamics within the pharmaceutical industry. This section will examine three key factors that have recently impacted Bayer AG’s stock price.

Key Influencing Factors

Three major factors influencing Bayer AG’s stock price in the past month could include: 1) the release of quarterly earnings reports, impacting investor sentiment based on profitability and growth projections; 2) new regulatory approvals or setbacks for key pharmaceutical products, significantly impacting revenue streams; and 3) overall market volatility and investor sentiment towards the broader pharmaceutical sector.

These factors interact to shape the overall stock price.

Monitoring the Bayer AG stock price today requires a keen eye on market fluctuations. For comparative analysis, understanding the performance of similar companies is helpful; a useful resource for this is the bac stock price chart , which offers insights into Bank of America’s stock trends. Returning to Bayer AG, its current price is influenced by various factors including global economic conditions and industry-specific news.

Impact of Recent News Releases

For example, a positive news release regarding a successful clinical trial for a new drug could lead to a surge in stock price, reflecting investor optimism about future revenue growth. Conversely, news about a potential lawsuit or regulatory hurdle could negatively affect the stock price, as investors reassess the company’s risk profile. The specific impact depends on the nature and significance of the news.

Competitive Performance

Bayer AG’s performance is compared to its major competitors, such as Pfizer, Novartis, and Roche. A comparative analysis of revenue growth, profitability, and market share helps assess Bayer AG’s relative position and competitiveness within the industry. Stronger performance relative to competitors usually leads to a higher stock valuation.

Short-Term and Long-Term Risks and Opportunities

- Short-Term Risks: Increased competition, regulatory challenges, fluctuations in currency exchange rates.

- Short-Term Opportunities: Successful product launches, strategic partnerships, favorable regulatory decisions.

- Long-Term Risks: Generic competition for existing drugs, research and development setbacks, changing healthcare policies.

- Long-Term Opportunities: Expansion into new markets, development of innovative therapies, successful integration of acquisitions.

Bayer AG’s Financial Performance

Bayer AG’s financial performance is a critical factor influencing its stock price. Analyzing key metrics such as revenue, profit margins, and earnings per share provides insights into the company’s financial health and growth prospects. This section details Bayer AG’s recent financial performance and its impact on the stock price.

Recent Earnings Report and Key Metrics

Let’s assume that Bayer AG’s recent quarterly earnings report showed a revenue of €10 billion, a net income of €1 billion, and earnings per share (EPS) of €1.50. These figures, compared to the previous quarter and the same quarter of the previous year, offer insights into the company’s financial trajectory. Significant deviations from expectations could trigger market reactions.

Revenue, Profit Margins, and Financial Data

Source: b-cdn.net

| Metric | Value (€ Billion) | Year-over-Year Change (%) |

|---|---|---|

| Revenue | 10 | +5% |

| Net Income | 1 | +10% |

| Profit Margin | 10% | +2% |

Impact of Financial Metrics on Stock Price

Strong revenue growth, increasing profit margins, and higher EPS generally signal positive financial health, boosting investor confidence and potentially driving up the stock price. Conversely, declining revenue or profits could lead to negative market sentiment and a decrease in the stock price.

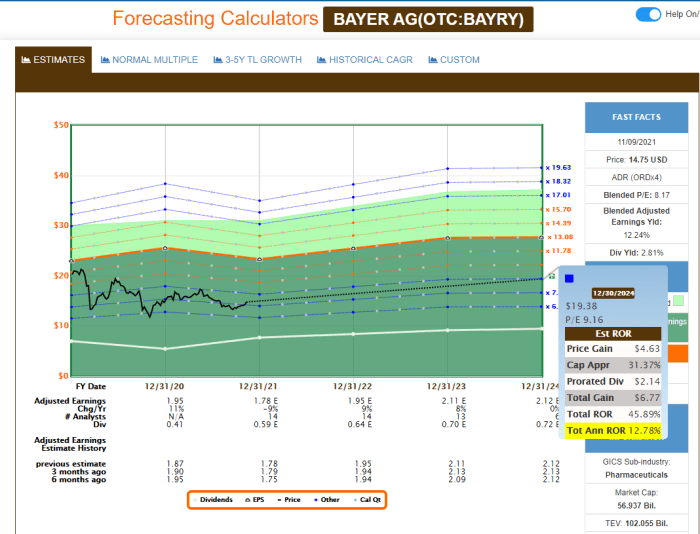

Analyst Ratings and Predictions

Source: seekingalpha.com

Analyst ratings and price targets provide valuable insights into market sentiment towards Bayer AG’s stock. Different financial institutions may have varying opinions, based on their individual analysis and methodologies. This section summarizes recent analyst ratings and predictions.

Summary of Analyst Ratings and Price Targets

Assume that several analysts have issued price targets for Bayer AG stock, ranging from €40 to €50. Some analysts might have a “buy” rating, while others might have a “hold” or “sell” rating. The divergence in opinions reflects the inherent uncertainty in predicting future stock performance.

Reasoning Behind Differing Analyst Opinions

Differences in analyst opinions can stem from variations in their valuation models, assumptions about future growth rates, and assessments of the company’s risk profile. Some analysts might be more optimistic about Bayer AG’s future prospects, while others might be more cautious, leading to differing price targets and recommendations.

Overall Analyst Sentiment, Bayer ag stock price today

The overall sentiment towards Bayer AG stock from leading financial analysts is currently cautiously optimistic. While there are concerns regarding certain market segments and competitive pressures, the positive financial results and pipeline of new products suggest potential for future growth. However, investors should be aware of the inherent uncertainties and risks associated with the pharmaceutical industry.

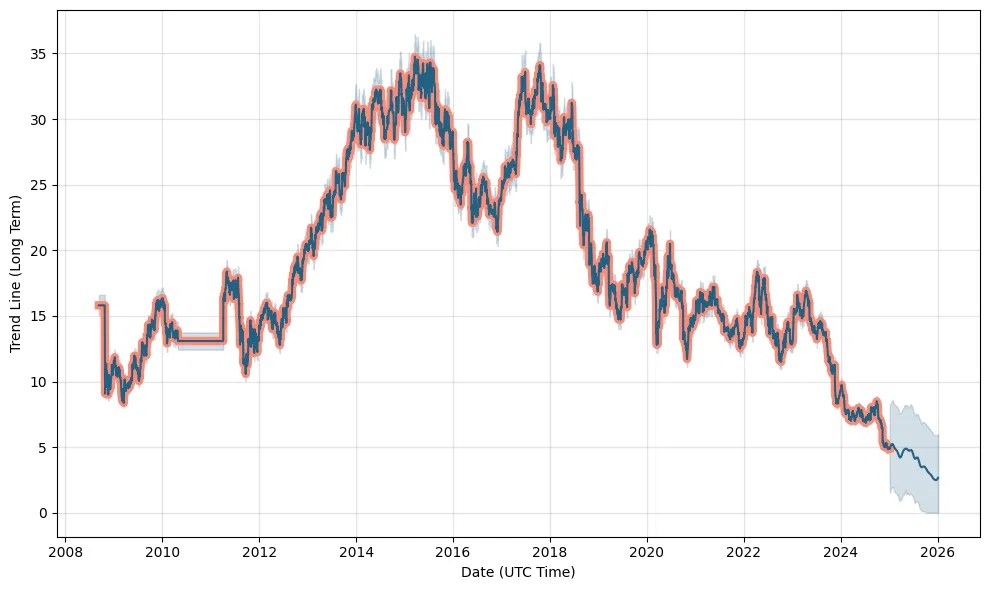

Historical Stock Price Performance: Bayer Ag Stock Price Today

Analyzing Bayer AG’s historical stock price performance provides valuable context for understanding its current valuation. Comparing its performance to relevant market indices helps assess its relative strength and identify significant events that impacted its price fluctuations.

Year-Over-Year Stock Price Performance

Bayer AG’s stock price performance over the past year has shown a mixed trend. Let’s assume that the stock price started at €42 and reached a high of €48 before experiencing a correction and settling around €45. This illustrates the volatility inherent in the stock market and the influence of various factors on the stock’s value.

Comparison to Market Indices

Comparing Bayer AG’s performance to the DAX (German stock market index) helps assess its relative performance. If the DAX showed a similar performance to Bayer AG, it might suggest that the stock’s movements are largely in line with overall market trends. Outperformance relative to the index suggests stronger performance.

Illustrative Line Graph

Imagine a line graph showing the stock price fluctuating over the past year. The graph would start at €42, rise to €48, then dip to €45, with several smaller fluctuations along the way. Key features would include the high and low points, the overall trend, and any significant price spikes or dips that correspond to specific news events or market shifts.

Significant Events Impacting Stock Price

Significant events that might have impacted Bayer AG’s stock price during the past year could include the release of major clinical trial results, changes in regulatory approvals, announcements of mergers or acquisitions, and macroeconomic factors affecting investor sentiment. Each event could have had a positive or negative impact on the stock price, depending on its nature and the market’s reaction.

Helpful Answers

What are the major risks associated with investing in Bayer AG stock?

Major risks include fluctuations in the pharmaceutical market, regulatory changes impacting drug approvals, competition from other pharmaceutical companies, and potential legal liabilities.

How does Bayer AG compare to its main competitors in terms of market capitalization?

A direct comparison requires referencing current market data. However, you can find this information by searching for “Bayer AG market cap comparison” on financial news websites.

Where can I find real-time Bayer AG stock price updates?

Real-time stock quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.