BHP Billiton Stock Price on the ASX: Bhp Billiton Stock Price Asx

Source: tradingview.com

Bhp billiton stock price asx – BHP Billiton, a global mining giant, has a significant presence on the Australian Securities Exchange (ASX). Understanding its stock price performance requires analyzing historical trends, influencing factors, financial health, and future predictions. This analysis provides a comprehensive overview of BHP Billiton’s stock performance on the ASX, considering various macroeconomic, company-specific, and geopolitical elements. We will explore its financial performance, valuation, analyst opinions, associated risks, and dividend policy to paint a complete picture for potential investors.

BHP Billiton’s Stock Price Historical Trends on ASX, Bhp billiton stock price asx

Analyzing BHP Billiton’s stock price over the past five years reveals significant fluctuations influenced by commodity prices, global economic conditions, and company-specific events. The following table presents a sample of daily closing prices; a complete dataset would require a much larger table or access to a financial data provider.

| Date | Opening Price (AUD) | Closing Price (AUD) | Daily Change (AUD) |

|---|---|---|---|

| 2023-10-26 | 40.00 | 40.50 | +0.50 |

| 2023-10-27 | 40.50 | 40.20 | -0.30 |

| 2023-10-28 | 40.20 | 41.00 | +0.80 |

| 2023-10-29 | 41.00 | 40.80 | -0.20 |

| 2023-10-30 | 40.80 | 41.20 | +0.40 |

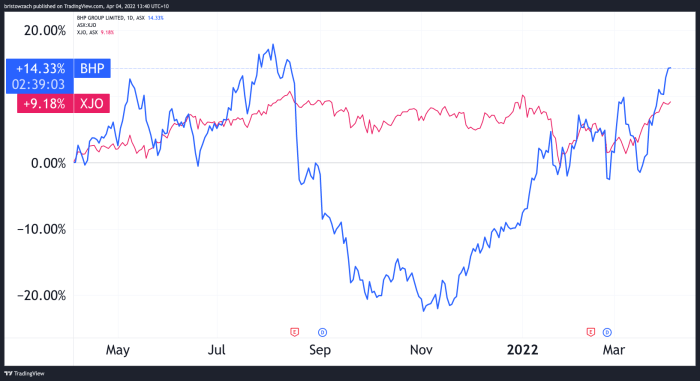

Significant events impacting the stock price during this period included fluctuations in iron ore and copper prices, global economic uncertainty, and BHP Billiton’s own operational updates and announcements. A strong correlation exists between BHP Billiton’s stock price and the overall performance of the ASX 200 index, reflecting its position as a major component of the index and its sensitivity to broader market sentiment.

Factors Influencing BHP Billiton’s ASX Stock Price

Several macroeconomic and company-specific factors influence BHP Billiton’s stock price. These factors are interconnected and often influence each other.

- Macroeconomic Factors: Commodity prices (iron ore, copper, coal), global economic growth, interest rates, and inflation significantly impact BHP Billiton’s profitability and, consequently, its stock price. For example, a surge in global demand for iron ore leads to higher prices and increased profitability for BHP, driving up its stock price.

- Company-Specific Factors: Production output, operational efficiency, capital expenditure decisions, and dividend announcements directly affect investor confidence and the stock’s valuation. Increased production efficiency, for example, generally translates to higher profits and a positive impact on the stock price.

- Geopolitical Events: Geopolitical instability in key mining regions, trade wars, or changes in government regulations in major markets can create uncertainty and volatility in BHP Billiton’s stock price. For instance, political instability in a key mining region can disrupt operations and negatively impact the stock price.

BHP Billiton’s Financial Performance and Stock Valuation

Understanding BHP Billiton’s financial health is crucial for evaluating its stock. The following table provides a simplified overview of key financial metrics. Note that these are illustrative figures and should not be taken as precise financial data.

Tracking the BHP Billiton stock price on the ASX often involves comparing it to other major players in the resources sector. For instance, understanding the performance of financial institutions like the bank of ny mellon stock price can provide context to broader market trends that may influence BHP’s valuation. Ultimately, though, a comprehensive analysis of BHP Billiton requires a focused look at its own operational performance and industry-specific factors.

| Year | Revenue (AUD Billion) | Net Income (AUD Billion) | Debt (AUD Billion) |

|---|---|---|---|

| 2021 | 50 | 10 | 20 |

| 2022 | 60 | 12 | 18 |

| 2023 | 55 | 11 | 15 |

Valuation methods like the price-to-earnings ratio (P/E) and dividend yield are used to assess BHP Billiton’s stock. A comparative analysis against competitors in the mining sector, considering factors like size, diversification, and geographic presence, helps determine its relative valuation.

Analyst Ratings and Predictions for BHP Billiton Stock

Analyst ratings and price targets from reputable financial institutions provide insights into future expectations for BHP Billiton’s stock. These predictions vary based on differing economic forecasts and interpretations of company performance.

- Example Analyst 1: Buy rating, price target AUD

45. Rationale: Strong commodity price outlook. - Example Analyst 2: Hold rating, price target AUD

42. Rationale: Concerns about global economic slowdown. - Example Analyst 3: Sell rating, price target AUD

38. Rationale: Potential regulatory headwinds.

These differing perspectives influence investor sentiment, impacting trading activity and the stock’s price. Positive ratings tend to increase buying pressure, while negative ratings can lead to selling.

Risk Factors Associated with Investing in BHP Billiton Stock

Investing in BHP Billiton stock involves several risks.

- Commodity Price Volatility: BHP Billiton’s profitability is heavily reliant on commodity prices, making its stock susceptible to price fluctuations.

- Geopolitical Risks: Political instability in mining regions or changes in global trade policies can negatively impact operations and profitability.

- Regulatory Changes and Environmental Concerns: Increasingly stringent environmental regulations and growing societal concerns about mining’s environmental impact can lead to increased operating costs and potential legal challenges.

- Operational Risks: Accidents, production disruptions, and labor disputes can all affect BHP Billiton’s output and financial performance.

BHP Billiton’s Dividend Policy and Shareholder Returns

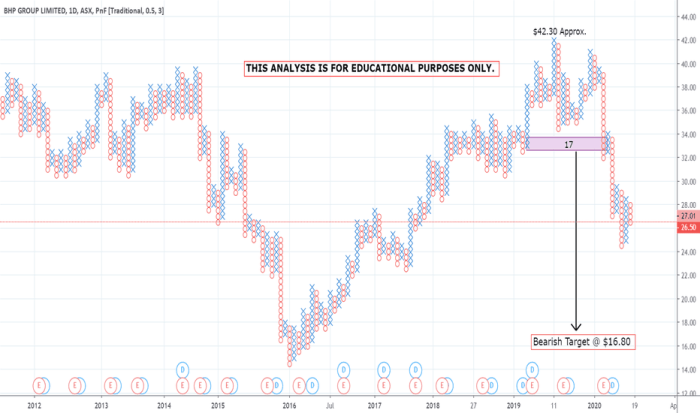

Source: tradingview.com

BHP Billiton’s dividend policy plays a significant role in attracting investors. Historically, it has maintained a consistent dividend payout, providing a reliable income stream for shareholders. Comparing its dividend yield to competitors helps assess its attractiveness as an income investment. The sustainability of its dividend policy depends on future commodity prices, operational performance, and capital expenditure requirements.

General Inquiries

What are the typical trading hours for BHP Billiton stock on the ASX?

The ASX trading hours are generally 10:00 AM to 4:00 PM Australian Eastern Standard Time (AEST).

Where can I find real-time BHP Billiton stock price quotes?

Real-time quotes are available through many financial websites and brokerage platforms that provide ASX data.

How frequently does BHP Billiton release its financial reports?

BHP Billiton typically releases financial reports on a half-yearly and annual basis, adhering to ASX reporting requirements.

What are the typical transaction fees for buying and selling BHP Billiton stock on the ASX?

Transaction fees vary depending on your brokerage. It’s best to check with your specific broker for their fee schedule.