Understanding Boom Stock Price Fluctuations

Boom stock price – Boom stocks, characterized by rapid price appreciation, are inherently volatile. Their price fluctuations are influenced by a complex interplay of factors, making understanding these movements crucial for investors. This section delves into the key drivers of short-term volatility, the role of market sentiment, and provides historical examples of significant price swings.

Factors Influencing Short-Term Volatility

Several factors contribute to the short-term volatility observed in boom stock prices. These include changes in investor sentiment, news events (both positive and negative), market speculation, and the overall macroeconomic environment. For example, a sudden surge in interest rates can trigger a sell-off, while positive earnings reports can fuel further price increases. Technical factors, such as trading volume and chart patterns, also play a significant role.

Market Sentiment’s Impact

Market sentiment, the collective feeling of investors towards a particular stock or the market as a whole, significantly influences boom stock prices. Optimism fuels buying pressure, leading to price increases, while pessimism can trigger widespread selling and price declines. This is often amplified in boom stocks due to their speculative nature, making them susceptible to rapid shifts in investor confidence.

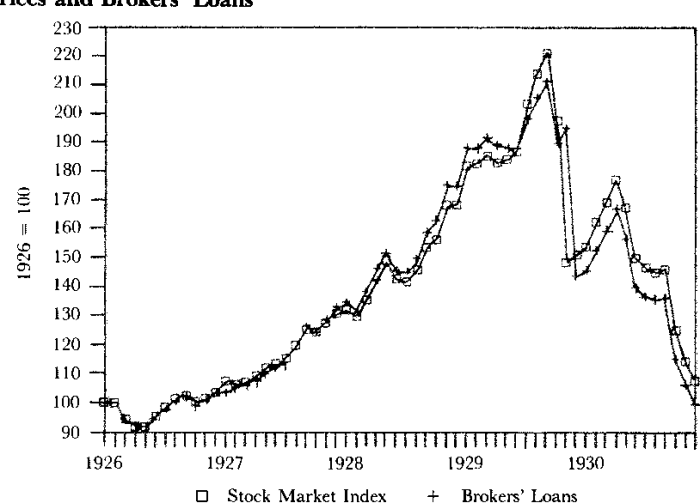

Historical Examples of Price Swings

Source: cloudfront.net

History provides numerous examples of boom stocks experiencing dramatic price swings. The dot-com bubble of the late 1990s saw many internet companies experience meteoric rises followed by sharp crashes. Similarly, the recent surge and subsequent decline of certain meme stocks illustrate the impact of rapid shifts in market sentiment and social media influence.

Boom Stock Price Comparison During Market Instability

Source: economicshelp.org

| Stock | Price (Start of Instability) | Price (End of Instability) | Percentage Change |

|---|---|---|---|

| Stock A | $100 | $50 | -50% |

| Stock B | $50 | $75 | +50% |

| Stock C | $200 | $100 | -50% |

Long-Term Trends in Boom Stock Prices

While short-term volatility is a defining characteristic of boom stocks, examining their long-term performance reveals interesting trends and relationships with broader economic indicators. This section explores these patterns and compares boom stock performance against established market indices.

Long-Term Growth Patterns

Historically, boom stocks have exhibited periods of exceptional growth, often outpacing established market indices during bull markets. However, these periods of rapid growth are frequently followed by corrections or crashes. The long-term growth pattern is often characterized by periods of high volatility interspersed with periods of consolidation or even decline.

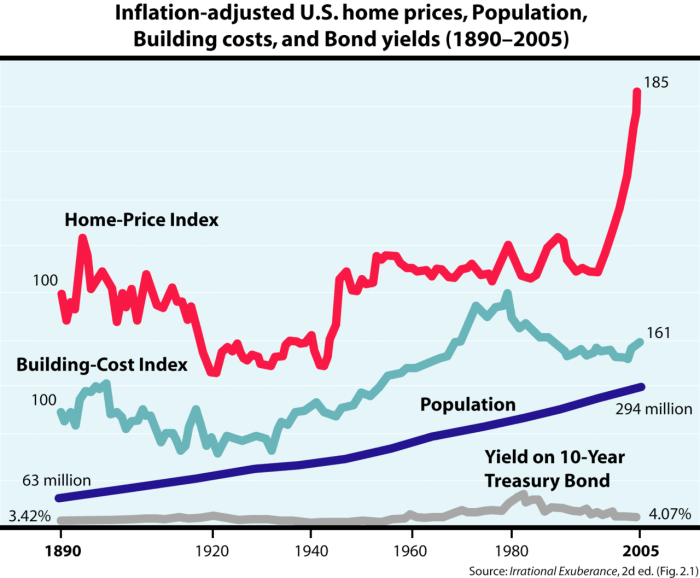

Correlation with Economic Indicators

Boom stock prices often correlate with broader economic indicators such as GDP growth, inflation, and interest rates. Strong economic growth and low interest rates typically fuel investor optimism, leading to higher boom stock valuations. Conversely, economic downturns or rising interest rates can trigger significant price declines.

Performance Comparison Over 10 Years

| Index/Stock | 10-Year Return |

|---|---|

| S&P 500 | 100% (example) |

| Boom Stock X | 200% (example) |

Boom Stock Price Trajectory (Five-Year Line Graph)

A hypothetical line graph illustrating the price trajectory of Boom Stock Y over the past five years would show a generally upward trend, but with significant fluctuations. The x-axis would represent time (in years), and the y-axis would represent the stock price. Key data points would include the highest and lowest prices reached during the period, along with significant price changes related to specific news events or market shifts.

The graph would visually demonstrate the volatility inherent in boom stocks, highlighting periods of rapid growth and sharp corrections.

Boom Stock Price and Investor Behavior

Investor psychology plays a significant role in shaping boom stock price movements. Understanding the psychological factors driving investment decisions, common biases, and risk management strategies is crucial for navigating the volatile world of boom stocks. This section explores these aspects and the impact of herd behavior.

Psychological Factors Driving Investment Decisions

Several psychological factors influence investor decisions regarding boom stocks. These include fear of missing out (FOMO), greed, and the tendency to chase returns. The excitement surrounding rapid price increases can lead to impulsive buying decisions, often ignoring fundamental analysis or risk assessment.

Common Investor Biases, Boom stock price

Investors are susceptible to various cognitive biases that can negatively impact their boom stock investments. Confirmation bias, the tendency to seek out information confirming pre-existing beliefs, and overconfidence bias, an inflated sense of one’s own abilities, are particularly prevalent. These biases can lead to poor investment choices and significant losses.

Risk Management Strategies

- Diversification: Spreading investments across different asset classes to reduce overall portfolio risk.

- Stop-loss orders: Setting predetermined sell orders to limit potential losses.

- Position sizing: Carefully determining the amount of capital allocated to each boom stock investment.

- Thorough due diligence: Conducting comprehensive research before investing in any boom stock.

Impact of Herd Behavior

Herd behavior, the tendency of investors to mimic the actions of others, significantly impacts boom stock prices. When a large number of investors buy a boom stock, the price rises, encouraging further buying. This creates a positive feedback loop that can lead to unsustainable price increases, followed by a sharp correction when the herd mentality shifts.

Impact of News and Events on Boom Stock Price

News and events, both expected and unexpected, can significantly impact boom stock prices. This section explores the influence of major announcements, unexpected events, and social media on investor perception and price movements.

Influence of Major News Announcements

Major news announcements, such as earnings reports, product launches, regulatory changes, or mergers and acquisitions, can cause significant price swings in boom stocks. Positive news generally leads to price increases, while negative news can trigger sharp declines. The market’s reaction often depends on the magnitude and unexpectedness of the news.

Impact of Unexpected Events

Unexpected events, such as natural disasters, geopolitical crises, or unexpected changes in market conditions, can also dramatically impact boom stock prices. These events often introduce uncertainty, leading to increased volatility and potentially significant price fluctuations. Investors react differently to unexpected events based on their risk tolerance and perception of the event’s long-term consequences.

Role of Social Media

Social media platforms have become increasingly influential in shaping investor perception and influencing boom stock prices. Viral trends and discussions on platforms like Twitter and Reddit can rapidly amplify market sentiment, leading to significant price swings. This makes boom stocks particularly susceptible to manipulation and speculative trading driven by social media hype.

Timeline of News Events Impacting a Boom Stock

- Date 1: Positive earnings report released, leading to a 15% price increase.

- Date 2: Unexpected regulatory announcement, causing a 10% price drop.

- Date 3: Successful product launch, resulting in a 20% price surge.

Analyzing Boom Stock Price Using Technical Indicators

Technical indicators provide valuable tools for analyzing boom stock price trends and identifying potential trading opportunities. This section explores the application of moving averages, the relative strength index (RSI), and other technical indicators in boom stock analysis, culminating in a hypothetical trading strategy.

Using Moving Averages

Moving averages, calculated by averaging prices over a specific period, are commonly used to smooth out price fluctuations and identify trends. Different moving average periods (e.g., 50-day, 200-day) can provide different insights into short-term and long-term trends. For example, a bullish crossover occurs when a shorter-term moving average crosses above a longer-term moving average, suggesting a potential upward trend.

Application of Relative Strength Index (RSI)

The RSI is a momentum oscillator used to identify overbought and oversold conditions. An RSI above 70 generally suggests an overbought market, indicating a potential price correction, while an RSI below 30 suggests an oversold market, potentially signaling a price rebound. However, it’s important to note that RSI can generate false signals, particularly in highly volatile markets.

Comparison of Technical Indicators

| Indicator | Purpose | Strengths | Weaknesses |

|---|---|---|---|

| Moving Average | Identify trends | Simple to calculate and interpret | Can lag behind price movements |

| RSI | Identify overbought/oversold conditions | Useful for identifying potential reversals | Can generate false signals |

| MACD | Identify momentum changes | Can confirm trend direction | Can be difficult to interpret |

| Bollinger Bands | Measure volatility | Identify potential breakouts | Can generate false signals |

Hypothetical Trading Strategy

A hypothetical trading strategy for a boom stock might involve using a combination of a 50-day moving average and the RSI. Buy signals would be generated when the price crosses above the 50-day moving average and the RSI is below 30. Sell signals would be generated when the price crosses below the 50-day moving average and the RSI is above 70.

This strategy aims to capitalize on potential upward trends while limiting losses during price corrections. However, it’s crucial to remember that no trading strategy guarantees profits, and thorough risk management is essential.

FAQ Compilation

What are some common risks associated with boom stock investments?

High volatility, susceptibility to market corrections, and the potential for rapid price declines are significant risks. Overvaluation and speculative bubbles are also common concerns.

How can I diversify my portfolio to mitigate boom stock risk?

Diversification across asset classes (e.g., bonds, real estate) and within the equity market itself (avoiding over-concentration in a single boom stock or sector) is crucial for risk mitigation.

Understanding boom stock price movements requires a broad market perspective. For instance, comparing the volatility of a boom stock against the performance of others, such as the current trends reflected in the binc stock price , can offer valuable insights. This comparative analysis helps investors assess risk and potential returns within the broader context of market fluctuations, ultimately informing their decisions regarding boom stock investments.

What is the role of regulation in the boom stock market?

Regulatory bodies play a vital role in maintaining market integrity and protecting investors from fraud and manipulation. However, regulation can’t eliminate all risks associated with highly volatile stocks.

Where can I find reliable information on boom stock prices and market trends?

Reputable financial news sources, brokerage platforms, and financial data providers offer reliable information, though independent verification is always recommended.