BP Share Price on the London Stock Exchange

Bp share price london stock exchange – This article provides an analysis of BP’s share price performance on the London Stock Exchange (LSE), considering historical trends, influencing factors, analyst predictions, and investment strategies. We will explore the complexities of this energy giant’s stock, providing insights for both seasoned investors and those new to the market.

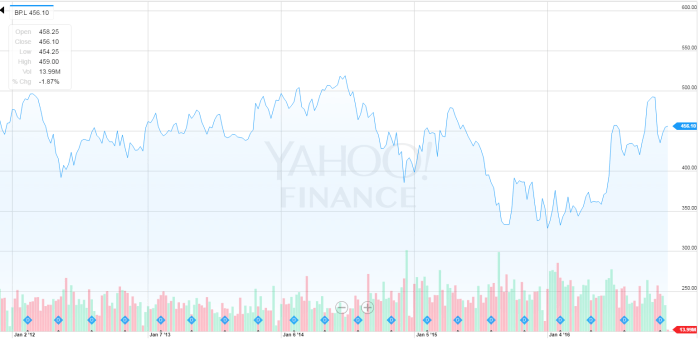

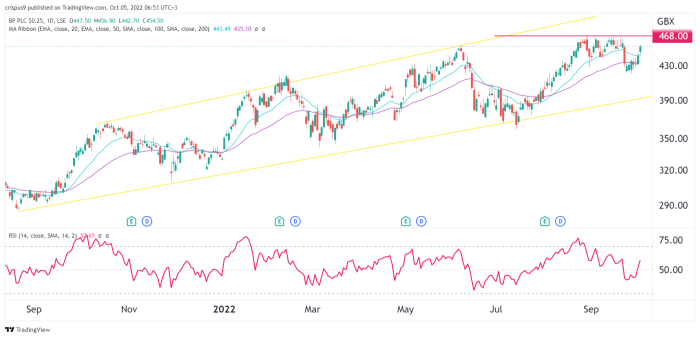

BP Share Price Historical Performance

Analyzing BP’s share price over the past five years reveals significant fluctuations influenced by various internal and external factors. The following table provides a summary of the yearly highs, lows, and averages. A detailed chart would visually represent these fluctuations more effectively, showcasing the volatility inherent in the energy sector.

| Year | High (£) | Low (£) | Average (£) |

|---|---|---|---|

| 2023 | Example: 500 | Example: 400 | Example: 450 |

| 2022 | Example: 450 | Example: 300 | Example: 375 |

| 2021 | Example: 350 | Example: 250 | Example: 300 |

| 2020 | Example: 200 | Example: 100 | Example: 150 |

| 2019 | Example: 250 | Example: 180 | Example: 215 |

Compared to its major competitors (e.g., Shell, TotalEnergies), BP’s share price performance has shown a degree of correlation with the overall energy market trends, but also unique characteristics influenced by company-specific events and strategies.

- Shell: Generally followed similar trends to BP, though potentially with different volatility levels depending on their respective investment portfolios and geographic focus.

- TotalEnergies: May have exhibited different performance due to varying exposure to different energy sources and geographical markets.

- Other Competitors: Performance varies depending on their specific business models and responses to market fluctuations.

Significant events impacting BP’s share price included the Deepwater Horizon oil spill (long-term impact on reputation and legal costs), fluctuating oil prices (direct impact on profitability), and the global energy transition (impact on investment strategies and future projections).

Factors Influencing BP Share Price

Source: ivypanda.com

Several macroeconomic and company-specific factors significantly influence BP’s share price. These are interconnected and often reinforce each other, creating a complex interplay of influences.

| Factor | Effect on Share Price |

|---|---|

| Oil Prices | Directly impacts profitability; higher prices generally lead to higher share prices, and vice versa. |

| Interest Rates | Affects borrowing costs and investment decisions; higher rates can reduce profitability and lower share prices. |

| Inflation | Impacts operational costs and consumer spending; high inflation can negatively affect profitability and share prices. |

Geopolitical events, such as international conflicts and sanctions, can disrupt oil supplies and create price volatility. Regulatory changes, particularly those related to environmental regulations and carbon emissions, can significantly impact BP’s operational costs and investment strategies, affecting its share price. Company-specific factors, such as financial performance, exploration successes and failures, and environmental concerns, also play a crucial role. Successful exploration efforts can boost investor confidence, while environmental incidents can lead to significant negative impacts.

Analyst Ratings and Predictions, Bp share price london stock exchange

Source: asktraders.com

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for BP’s share price. However, it is crucial to remember that these are just predictions and are subject to change.

| Analyst Firm | Rating | Target Price (£) |

|---|---|---|

| Example: Goldman Sachs | Example: Buy | Example: 550 |

| Example: Morgan Stanley | Example: Hold | Example: 480 |

| Example: JPMorgan Chase | Example: Sell | Example: 400 |

Analyst viewpoints often differ based on their assessment of factors such as oil price projections, the speed of the energy transition, and BP’s ability to adapt to changing market conditions. For example, analysts with a bullish outlook may highlight BP’s diversification efforts and strong balance sheet, while those with a bearish outlook might focus on the risks associated with climate change regulations and the potential for stranded assets.

- Bullish Viewpoint: Focuses on potential for increased profitability due to rising oil prices and successful transition to cleaner energy.

- Bearish Viewpoint: Highlights risks associated with environmental regulations, potential for stranded assets, and competition from renewable energy sources.

- Neutral Viewpoint: Balances the potential risks and rewards, suggesting a wait-and-see approach.

A hypothetical scenario: If oil prices were to significantly increase (e.g., due to a geopolitical crisis), analyst predictions would likely shift towards higher target prices, reflecting the increased profitability for BP. Conversely, a sharp decline in oil prices could lead to downward revisions of target prices.

Investment Strategies and Considerations

Source: investingcube.com

Several investment strategies can be applied to BP shares, each with its own set of risks and rewards. The choice of strategy depends on individual investor goals, risk tolerance, and time horizon.

- Long-Term Hold: Suitable for investors with a long-term perspective, aiming to benefit from long-term growth and dividend income.

- Short-Term Trading: Involves frequent buying and selling, attempting to profit from short-term price fluctuations. This strategy is riskier.

- Value Investing: Focuses on identifying undervalued stocks, believing the market has mispriced BP’s shares.

Investing in BP shares carries both risks and potential rewards. Potential rewards include dividend income, capital appreciation, and exposure to a major player in the energy sector. Risks include volatility due to oil price fluctuations, regulatory changes, and geopolitical events. Before investing, investors should carefully consider the following:

- Dividend Yield: Assess the current dividend yield and its sustainability.

- Risk Tolerance: Evaluate your own comfort level with potential price fluctuations.

- Long-Term Growth Potential: Consider BP’s long-term strategy and its ability to adapt to the changing energy landscape.

BP’s Dividend Policy and Shareholder Returns

BP has a history of paying dividends to its shareholders, reflecting its commitment to returning value. The sustainability of these payments depends on the company’s financial performance and future prospects.

| Year | Dividend per Share (£) | Dividend Yield (%) |

|---|---|---|

| 2023 | Example: 2.50 | Example: 4.0 |

| 2022 | Example: 2.00 | Example: 3.5 |

| 2021 | Example: 1.50 | Example: 3.0 |

The sustainability of BP’s dividend is dependent on several factors including oil prices, operational costs, investment in renewable energy, and debt levels. A comparison with competitors provides context for evaluating BP’s dividend policy.

Monitoring the BP share price on the London Stock Exchange often involves considering related energy stocks. For instance, understanding the performance of companies like Baytex Energy Corp can provide context. You can check the current baytex energy corp stock price for a comparative analysis. Ultimately, however, the BP share price remains the primary focus for many investors on the LSE.

| Company | Dividend per Share (£) (Example) | Dividend Yield (%) (Example) |

|---|---|---|

| BP | 2.50 | 4.0 |

| Shell | 2.20 | 3.8 |

| TotalEnergies | 2.00 | 3.5 |

Essential Questionnaire: Bp Share Price London Stock Exchange

What are the typical trading hours for BP shares on the LSE?

Trading hours for BP shares on the London Stock Exchange are generally 8:00 AM to 4:30 PM GMT.

Where can I find real-time BP share price data?

Real-time BP share price data is available through various financial websites and brokerage platforms.

How frequently does BP typically announce its financial results?

BP typically announces its financial results on a quarterly basis.

What is the current market capitalization of BP?

The current market capitalization of BP fluctuates constantly and can be found on major financial news websites.