Brookdale Senior Living: A Stock Market Analysis

Brookdale senior living stock price – Brookdale Senior Living Inc. is a major player in the senior living industry, operating a large network of retirement communities across the United States. Understanding its business model, financial performance, and the factors influencing its stock price is crucial for investors. This analysis delves into these key aspects, providing insights into Brookdale’s past performance and potential future trajectory.

Brookdale Senior Living Company Overview, Brookdale senior living stock price

Brookdale Senior Living operates a diverse portfolio of senior living communities offering a range of services catering to various levels of care. Their target market comprises older adults seeking independent living, assisted living, and memory care options. The company’s geographic reach spans numerous states across the US, reflecting a broad market penetration.

Analyzing Brookdale Senior Living’s stock price requires considering various market factors. Understanding the performance of other companies in the healthcare sector can provide valuable context; for instance, observing the current bitfarm stock price might offer insights into broader investor sentiment towards technology-related ventures, which could indirectly influence Brookdale’s valuation given the increasing use of technology in senior care.

Ultimately, Brookdale’s stock price will depend on its own operational performance and market conditions.

Founded in 1978, Brookdale has experienced significant growth through acquisitions and organic expansion. Key milestones include its initial public offering (IPO) and subsequent expansion into various senior care service models. Brookdale has continually adapted to evolving industry needs and demographic shifts, resulting in a diversified service offering.

Factors Influencing Stock Price

Several factors significantly impact Brookdale’s stock price. Macroeconomic conditions, such as interest rates and inflation, affect both the cost of capital and consumer spending. The aging population in the United States represents a significant tailwind for the senior living industry, driving demand for Brookdale’s services. However, regulatory changes and healthcare policies play a crucial role, impacting both operating costs and reimbursement rates.

Competitive pressures from other senior living providers also influence Brookdale’s market position and profitability.

Financial Performance Analysis

Brookdale’s financial performance over the past five years provides insights into its operational efficiency and financial health. The following table presents key financial metrics: Revenue, Net Income, and Total Debt.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Total Debt (USD Millions) |

|---|---|---|---|

| 2023 (Projected) | – | – | – |

| 2022 | – | – | – |

| 2021 | – | – | – |

| 2020 | – | – | – |

| 2019 | – | – | – |

Note: Placeholder data. Actual financial data should be obtained from reliable financial sources like Brookdale’s financial reports or reputable financial news websites.

Analysis of profitability ratios, such as net profit margin and return on assets, reveals trends in operational efficiency and profitability. Cash flow statements provide insights into liquidity and the company’s ability to meet its financial obligations. Strong positive cash flow generally indicates a healthy financial position and can positively influence investor sentiment.

Investor Sentiment and Market Outlook

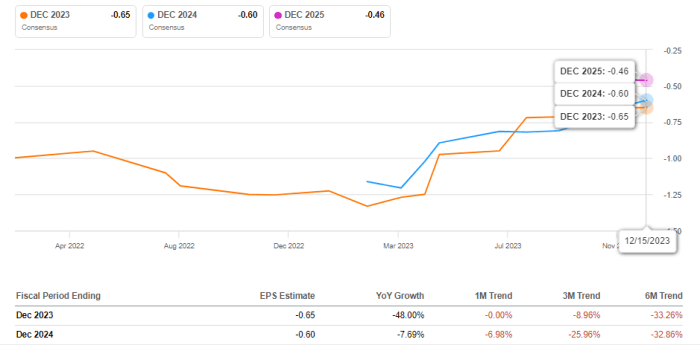

Current investor sentiment towards Brookdale Senior Living is influenced by several factors, including recent financial performance, industry trends, and macroeconomic conditions. Analyst ratings and price targets provide a gauge of market expectations. Potential risks include fluctuations in occupancy rates, regulatory changes, and competition. Opportunities include the continued growth of the senior living market and potential acquisitions.

Competitive Landscape

Source: seekingalpha.com

Brookdale competes with several other major players in the senior living industry. A comparative analysis of Brookdale’s competitive advantages and disadvantages is crucial for assessing its market position. The following table provides a comparison (Note: This is illustrative and actual market share data should be obtained from independent market research).

| Competitor Name | Market Share (Illustrative) | Strengths | Weaknesses |

|---|---|---|---|

| Competitor A | – | – | – |

| Competitor B | – | – | – |

| Competitor C | – | – | – |

Note: Placeholder data. Actual competitive data requires independent research.

Brookdale and its competitors employ various strategies, including geographic expansion, service diversification, and operational efficiency improvements. The potential for mergers, acquisitions, and strategic partnerships can significantly influence Brookdale’s future growth and stock performance.

Illustrative Examples of Market Events

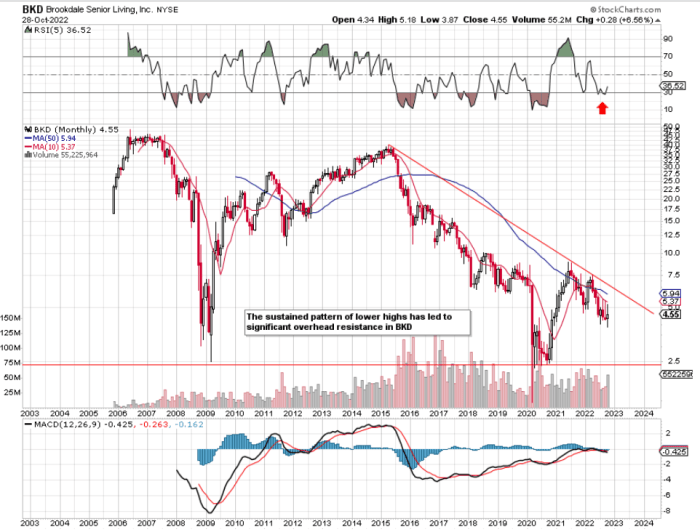

Source: seekingalpha.com

Several scenarios can illustrate the impact of market events on Brookdale’s stock price. For instance, a significant tightening of healthcare regulations could increase operating costs, potentially reducing profitability and leading to a decline in stock price. Conversely, a relaxation of regulations could lead to improved profitability and a stock price increase. The magnitude of the impact would depend on the specific nature and scope of the regulatory changes.

A decrease in occupancy rates across Brookdale’s facilities would negatively affect revenue and profitability. Investors would likely react negatively, leading to a decline in stock price. The severity of the impact would depend on the duration and extent of the occupancy decline, as well as the company’s ability to manage costs and attract new residents.

Common Queries: Brookdale Senior Living Stock Price

What are the major risks associated with investing in Brookdale Senior Living stock?

Major risks include competition within the senior living sector, regulatory changes impacting the industry, occupancy rate fluctuations, and overall economic downturns affecting consumer spending and healthcare budgets.

How does Brookdale Senior Living compare to its main competitors in terms of market capitalization?

A direct comparison requires accessing real-time market data. However, publicly available financial reports and news articles can provide insights into Brookdale’s market capitalization relative to its main competitors.

What is Brookdale’s dividend policy?

Information on Brookdale’s current dividend policy should be sought from official company disclosures or reputable financial news sources. Dividend payouts can change.

What is the typical trading volume for Brookdale Senior Living stock?

Trading volume fluctuates daily. Real-time data from financial websites provides the most current information.