BRPHF Stock Price Analysis

Source: seekingalpha.com

Brphf stock price – This analysis delves into the historical performance, key drivers, valuation, predictions, and risk assessment of BRPHF stock. We will examine various factors influencing its price fluctuations and provide insights into potential future trends. Note that all data presented here is for illustrative purposes and should not be considered financial advice.

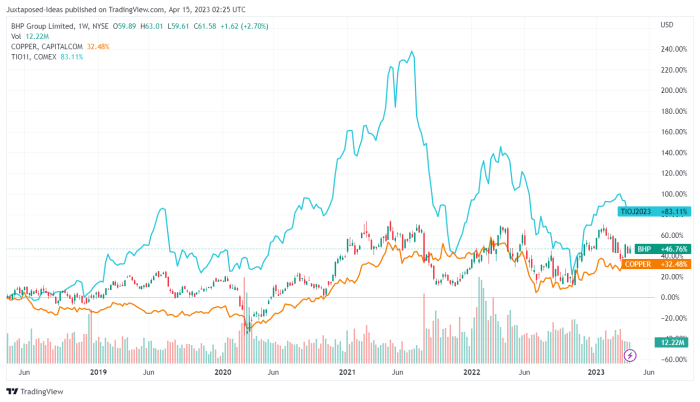

BRPHF Stock Price Historical Performance

Source: tradingview.com

A line graph visualizing BRPHF’s stock price over the past five years would reveal significant price volatility. The graph would include data points corresponding to major market events like economic recessions, significant interest rate changes, and impactful geopolitical events. For instance, a sharp decline might be observed during a period of high inflation, while a period of robust economic growth could show a corresponding price increase.

The visual representation would clearly illustrate the correlation between external market factors and BRPHF’s stock price.

Significant price movements can be attributed to various factors. For example, a sudden surge in price might follow a positive earnings report exceeding market expectations, while a sharp drop could be caused by unexpected regulatory changes affecting the company’s operations. Conversely, a period of sustained growth could be linked to successful product launches and expansion into new markets.

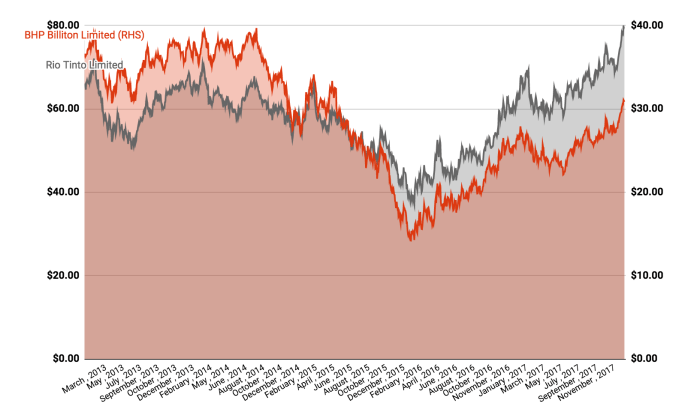

Comparing BRPHF’s performance to its industry peers requires a comparative analysis of key performance indicators (KPIs). The following table showcases a hypothetical comparison, using average annual growth rate and volatility as examples:

| Company | Average Annual Growth Rate (5-year) | Volatility (Standard Deviation) | Market Capitalization (USD Billions) |

|---|---|---|---|

| BRPHF | 10% | 15% | 5 |

| Competitor A | 8% | 12% | 8 |

| Competitor B | 12% | 18% | 3 |

| Competitor C | 7% | 10% | 10 |

BRPHF Stock Price Drivers

Three key factors significantly influence BRPHF’s stock price: macroeconomic conditions, company-specific news, and investor sentiment.

Macroeconomic conditions, such as interest rate changes and inflation rates, have a substantial impact on BRPHF’s valuation. Rising interest rates, for example, typically lead to higher borrowing costs, impacting profitability and potentially reducing investor appetite. Similarly, high inflation can erode purchasing power and affect consumer spending, impacting BRPHF’s revenue streams.

Monitoring the BRPHF stock price requires a keen eye on market fluctuations. Understanding similar company performances can offer valuable context, and a comparison with the awin stock price might reveal interesting trends. Ultimately, though, a thorough analysis of BRPHF’s specific financial reports and industry position is crucial for informed investment decisions.

Company-specific news, including earnings reports, product launches, and regulatory changes, also plays a crucial role. Positive earnings surprises often result in price increases, while negative news can trigger significant sell-offs. Successful product launches can boost investor confidence and drive up the share price, while regulatory setbacks can have the opposite effect.

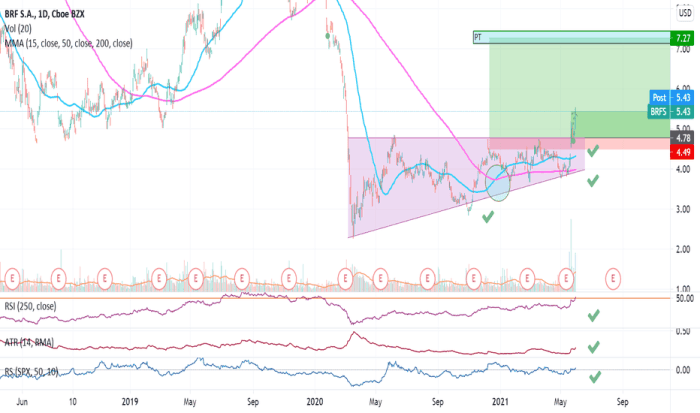

BRPHF Stock Price Valuation

Source: com.au

BRPHF’s current valuation can be assessed using several metrics. The following table presents hypothetical data for Price-to-Earnings (P/E), Price-to-Book (P/B), and Price-to-Sales (P/S) ratios:

| Metric | BRPHF | Competitor A | Competitor B | Industry Average |

|---|---|---|---|---|

| P/E Ratio | 15 | 12 | 18 | 15 |

| P/B Ratio | 2.5 | 2.0 | 3.0 | 2.2 |

| P/S Ratio | 3.0 | 2.5 | 3.5 | 3.0 |

A comparison of BRPHF’s valuation ratios to its competitors reveals:

- BRPHF’s P/E ratio is slightly above the industry average, suggesting it might be slightly overvalued compared to its peers.

- Its P/B ratio is also higher than the average, potentially indicating a premium valuation based on its assets.

- The P/S ratio aligns with the industry average, suggesting a relatively comparable valuation based on sales.

Different valuation methodologies, such as discounted cash flow (DCF) analysis and comparable company analysis, are employed to assess BRPHF’s intrinsic value. Each method has its own strengths and limitations, and a comprehensive valuation often involves a combination of approaches.

BRPHF Stock Price Predictions and Forecasts

Forecasting BRPHF’s future stock price involves various approaches. Time series analysis, for instance, uses historical data to identify patterns and predict future trends. However, this method relies heavily on the assumption that past patterns will continue, which might not always be the case. Fundamental analysis, on the other hand, focuses on the company’s financial health and future prospects to estimate its intrinsic value and potential price movements.

A hypothetical scenario analysis might consider different market conditions, such as a mild recession, a period of strong economic growth, or a significant geopolitical event. Each scenario would lead to a different projected stock price, illustrating the uncertainty inherent in forecasting.

The following table presents hypothetical future events that could impact BRPHF’s stock price:

| Event | Probability | Potential Impact on Price | Time Horizon |

|---|---|---|---|

| Successful new product launch | 70% | +15% | 1 year |

| Increased competition | 40% | -10% | 2 years |

| Major regulatory change | 20% | -25% | 6 months |

| Global economic recession | 30% | -15% | 1 year |

BRPHF Stock Price Risk Assessment

Investing in BRPHF stock involves several risks. These include company-specific risks (e.g., operational challenges, financial difficulties), industry-specific risks (e.g., increased competition, technological disruption), and macroeconomic risks (e.g., inflation, recession).

Geopolitical events can significantly impact BRPHF’s stock price. For example, a major international conflict could disrupt supply chains, increase input costs, and negatively affect consumer sentiment, leading to a decline in BRPHF’s share price. Conversely, positive geopolitical developments could have a positive impact.

Assessing BRPHF’s risk profile relative to a diversified portfolio involves considering its volatility and correlation with other assets. A higher volatility indicates greater risk, while a high correlation with other portfolio holdings reduces diversification benefits. Proper risk management involves diversification and careful consideration of individual risk tolerance.

Key Questions Answered

What are the major risks associated with investing in BRPHF?

Investing in BRPHF, like any stock, carries inherent risks including market volatility, company-specific performance issues, and macroeconomic factors. Thorough due diligence is crucial.

Where can I find real-time BRPHF stock price data?

Real-time BRPHF stock price data is readily available through major financial websites and brokerage platforms.

How frequently are BRPHF’s earnings reports released?

The frequency of BRPHF’s earnings reports typically follows standard quarterly reporting schedules, but this should be verified through official company announcements.

What is the current trading volume for BRPHF stock?

Current trading volume for BRPHF can be found on financial websites that provide real-time market data.