Market Overview of Charging Point Stocks

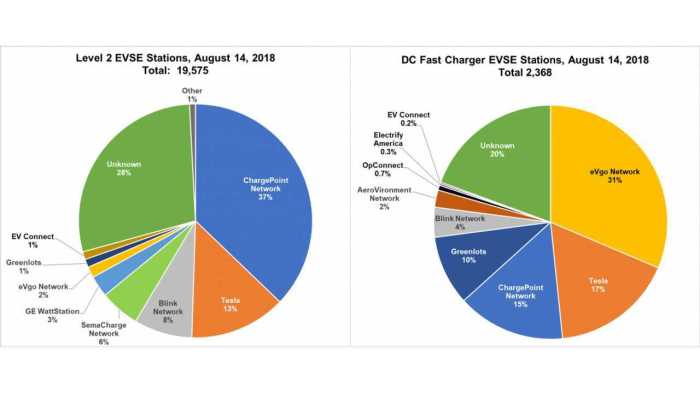

Charging point stock price – The electric vehicle (EV) charging infrastructure market is experiencing rapid growth, driven by increasing EV adoption and supportive government policies. This growth translates directly into opportunities and volatility within the charging point stock market. Several key players are vying for market share, leading to a dynamic and competitive landscape.

Major Players and Market Capitalization

Several companies are prominent in the charging point stock market, each with varying market capitalizations and strategies. A comparison of three leading companies provides a snapshot of the current market dynamics.

| Company Name | Market Cap (Illustrative – replace with current data) | Stock Symbol (Illustrative – replace with actual symbols) | Recent Price Change (Illustrative – replace with current data) |

|---|---|---|---|

| Company A | $XX Billion | COMP A | +X% |

| Company B | $YY Billion | COMP B | -Y% |

| Company C | $ZZ Billion | COMP C | +Z% |

Note: Market capitalization and price change figures are illustrative and should be replaced with real-time data from reliable financial sources. Stock symbols are also illustrative and need to be updated with accurate information.

Factors Influencing Charging Point Stock Prices

Several factors significantly impact the valuation of charging point companies. These range from government regulations and consumer behavior to technological advancements and unexpected news events.

Government Regulations and Consumer Adoption

Government incentives and regulations play a crucial role. Subsidies for EV purchases and the installation of charging stations directly stimulate demand. Conversely, stricter emission regulations accelerate the transition to EVs, boosting the need for charging infrastructure. Similarly, increased consumer adoption of EVs creates a direct correlation with increased demand for charging points, positively influencing stock prices. A slowdown in EV sales, however, can negatively impact the sector.

Technological Advancements and News Events

Technological advancements, such as faster charging speeds and improved battery technology, influence stock valuations. Innovations that reduce charging times or increase charging efficiency are generally viewed favorably by investors. Conversely, news events, such as recalls of charging stations or negative press regarding safety concerns, can significantly impact stock prices. For example, a major safety incident involving a charging station could lead to a temporary or sustained drop in the stock price of the affected company.

Financial Performance of Charging Point Companies

Analyzing the financial performance of charging point companies is crucial for investors. This includes examining revenue streams, profitability, and growth potential. A comparative analysis of key financial metrics provides valuable insights.

Revenue Streams and Profitability

Charging point companies typically generate revenue through various streams, including charging fees, subscription services, and partnerships with EV manufacturers or other businesses. Profitability varies significantly depending on factors such as operating costs, the scale of operations, and the pricing strategies employed. The industry’s growth potential is substantial, given the expected rise in EV adoption globally. However, achieving profitability can be challenging in the early stages, especially for smaller companies.

Revenue Growth Comparison, Charging point stock price

A hypothetical comparison of the revenue growth of two major competitors, Company X and Company Y, over the past five years can be illustrated as follows:

Company X: Year 1 – $10 million; Year 2 – $15 million; Year 3 – $22 million; Year 4 – $30 million; Year 5 – $40 million. This demonstrates a consistent year-on-year growth.

The volatility in the charging point stock price market is noteworthy, reflecting investor sentiment towards the burgeoning electric vehicle sector. It’s interesting to compare this with the performance of more established players; for instance, understanding the current trends in the aviva stock price can offer a contrasting perspective on market stability. Ultimately, both charging point and insurance sector investments require careful analysis before committing capital.

Company Y: Year 1 – $8 million; Year 2 – $12 million; Year 3 – $18 million; Year 4 – $25 million; Year 5 – $35 million. While also showing growth, Company Y’s growth rate is slightly lower than Company X.

Key Financial Metrics

- Revenue growth

- Profit margins

- Customer acquisition costs

- Number of charging stations deployed

- Utilization rates of charging stations

- Debt-to-equity ratio

- Cash flow from operations

Investment Strategies for Charging Point Stocks

Source: capital.com

Investing in charging point stocks presents both opportunities and risks. Understanding these aspects and employing appropriate investment strategies is crucial for success.

Risks and Investment Strategies

Potential risks include competition, regulatory changes, technological disruption, and the overall economic climate. Long-term investors might employ a buy-and-hold strategy, focusing on companies with strong fundamentals and long-term growth potential. Short-term investors might utilize more active trading strategies, taking advantage of short-term price fluctuations. Valuation methods such as discounted cash flow (DCF) analysis or comparable company analysis are often used to assess the worth of charging point companies.

Macroeconomic Factors

Macroeconomic factors, such as interest rates, significantly influence investment decisions. Higher interest rates generally increase the cost of borrowing, potentially impacting the profitability of charging point companies and making investments less attractive. Conversely, lower interest rates can stimulate investment and boost the sector’s growth.

Future Outlook for Charging Point Stocks

Source: motor1.com

The future of the EV charging market is promising, but also presents challenges. Technological advancements and evolving market dynamics will shape the industry’s trajectory and influence stock prices.

Future Trends and Scenarios

| Scenario | Probability (Illustrative) | Impact on Stock Prices (Illustrative) |

|---|---|---|

| Widespread adoption of wireless charging technology | Medium | Potentially significant positive impact on select companies |

| Increased competition and price wars | High | Potential negative impact on profit margins and stock prices |

| Government support for EV infrastructure continues to grow | High | Likely positive impact on overall market growth |

| Significant technological breakthroughs in battery technology leading to reduced charging needs | Low | Potentially negative impact on long-term demand for charging infrastructure |

Note: Probabilities and impact assessments are illustrative and based on current trends and expert opinions. Actual outcomes may vary significantly.

FAQ Summary: Charging Point Stock Price

What are the main risks associated with investing in charging point stocks?

Risks include competition, technological obsolescence, regulatory changes, and the overall volatility of the stock market. Dependence on EV adoption rates also presents a significant risk factor.

How can I compare the valuations of different charging point companies?

Valuation methods include price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and discounted cash flow (DCF) analysis. Comparing these metrics across different companies provides a relative valuation perspective.

What is the impact of interest rate changes on charging point stock prices?

Rising interest rates generally increase borrowing costs for companies, potentially impacting profitability and slowing growth. This can lead to lower stock valuations, particularly for companies with high debt levels.

Which government regulations significantly impact the charging point industry?

Regulations related to emissions standards, grid infrastructure development, and subsidies for EV adoption and charging infrastructure directly influence the sector’s growth and profitability.