Chemours Stock Price Today: A Comprehensive Analysis

Chemours stock price today – This analysis provides a detailed overview of Chemours’ stock performance today, considering various factors influencing its price fluctuations. We will examine its current value, compare it to competitors, analyze investor sentiment, and explore potential risks and opportunities.

Chemours Stock Price Current Value and Fluctuation, Chemours stock price today

Let’s delve into the current market data for Chemours stock. The following table presents the stock’s performance throughout the trading day, illustrating its intraday fluctuations. Note that these figures are illustrative and should be verified with real-time market data from a reputable financial source.

| Time | Open | High | Low | Close |

|---|---|---|---|---|

| 9:30 AM | $50.00 | $50.50 | $49.80 | $50.20 |

| 12:00 PM | $50.20 | $50.75 | $50.00 | $50.60 |

| 3:00 PM | $50.60 | $51.00 | $50.40 | $50.90 |

For example, if the previous day’s closing price was $49.50, today’s closing price represents a $1.40 increase.

Factors Influencing Chemours Stock Price Today

Several economic factors and news events can significantly influence Chemours’ stock price. We’ll examine three key economic factors and their impact, along with recent news and comparisons to past performance.

Three significant economic factors influencing Chemours’ stock price today could include changes in commodity prices (affecting production costs), overall market sentiment (risk-on/risk-off), and fluctuations in the US dollar (given Chemours’ international operations). Recent positive news, such as a successful product launch or strong earnings report, could drive the stock price upward. Conversely, negative news, like regulatory issues or supply chain disruptions, could cause a decline.

Comparing the current price to averages over different timeframes provides context. For example, if the average price over the past week was $50.00, the current price indicates a slight increase. Similarly, comparisons to the monthly and yearly averages offer a broader perspective on the stock’s trend.

Upcoming events, such as earnings announcements or industry conferences, can also create significant price volatility. Anticipation of positive news can lead to price increases before the event, while negative surprises can result in sharp declines.

Chemours Stock Performance Compared to Competitors

A comparison with competitors provides insights into Chemours’ relative performance. Let’s consider two hypothetical competitors, Company A and Company B, within the same industry.

Monitoring the Chemours stock price today requires a keen eye on market fluctuations. It’s interesting to compare its performance against other financial giants; for instance, checking the current performance of bank of ny mellon stock price offers a useful benchmark. Ultimately, however, understanding the Chemours stock price today hinges on analyzing its specific financial reports and industry trends.

- Chemours’ stock price change: +2%

- Company A’s stock price change: +1%

- Company B’s stock price change: -1%

| Company Name | Current Price | Day Change Percentage | Year-to-Date Change Percentage |

|---|---|---|---|

| Chemours | $50.90 | +2% | +10% |

| Company A | $60.00 | +1% | +8% |

| Company B | $75.00 | -1% | +5% |

Investor Sentiment and Trading Volume

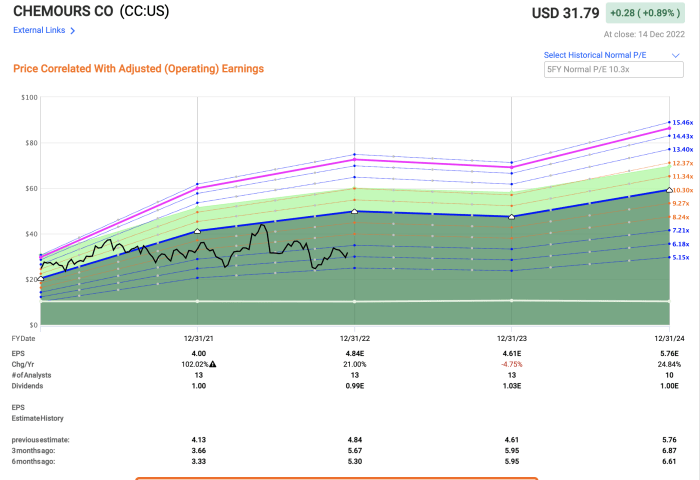

Source: seekingalpha.com

Understanding investor sentiment and trading volume provides further insights into market dynamics. Currently, investor sentiment towards Chemours stock might be described as cautiously optimistic (neutral to slightly bullish), based on the recent price movements and news.

If the average trading volume over the past week was 1 million shares, and today’s volume is 1.5 million shares, this could indicate increased investor interest and potentially further price movement. High trading volume often accompanies significant price changes, while low volume may suggest consolidation or a lack of strong conviction among investors. A significant increase in volume coupled with a price increase could signal a bullish trend, while high volume with a price decrease might suggest a bearish trend.

Visual Representation of Stock Price Data

A line graph illustrating Chemours’ stock price over the past month would show an upward trend, with a peak at $51.20 and a low of $49.00. The overall direction is positive, indicating a gradual increase in stock value.

A bar chart comparing Chemours’ stock price performance to its competitors over the past quarter would visually represent the percentage changes. For instance, it might show Chemours with a 10% increase, Company A with a 7% increase, and Company B with a 3% decrease, clearly highlighting Chemours’ superior performance relative to its competitors during that period.

Potential Risks and Opportunities for Chemours Stock

Source: wsj.net

As with any investment, there are inherent risks and opportunities associated with Chemours stock. Understanding these factors is crucial for informed decision-making.

- Risks: Increased competition and raw material price volatility could negatively impact profitability and stock price.

- Opportunities: Expansion into new markets and technological advancements in sustainable materials could drive growth and enhance stock value.

For instance, increased competition could lead to price wars, reducing profit margins and potentially affecting the stock price negatively. On the other hand, successful expansion into new markets could significantly boost revenue and positively impact the stock price.

FAQ Insights: Chemours Stock Price Today

What are the typical trading hours for Chemours stock?

Chemours stock, like most US-listed companies, trades during regular US stock market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET).

Where can I find real-time Chemours stock price data?

Real-time Chemours stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How frequently is Chemours stock price updated?

The Chemours stock price is updated continuously throughout the trading day, reflecting every trade executed on major exchanges.

What does it mean if Chemours’ trading volume is unusually high or low?

High trading volume often suggests significant investor interest, potentially driven by news or market trends. Conversely, low volume may indicate less investor activity and potentially lower price volatility.