Cortiva Stock Price Analysis

Cortiva stock price – This analysis provides a comprehensive overview of Cortiva’s stock price performance, influential factors, financial health, competitive landscape, and analyst predictions. We will explore historical trends, valuation methods, and the overall market dynamics impacting Cortiva’s stock price.

Cortiva Stock Price History and Trends

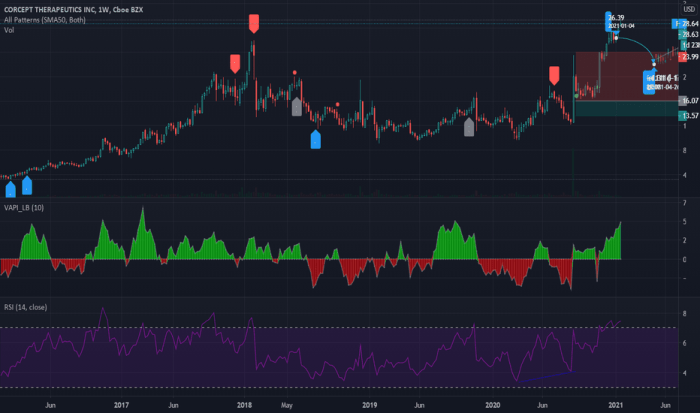

Analyzing Cortiva’s stock price movements over the past five years reveals significant fluctuations influenced by various internal and external factors. The following table and graph provide a visual representation of this historical data.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 10.50 | 11.20 |

| 2019 | Q2 | 11.00 | 10.80 |

| 2020 | Q1 | 10.75 | 12.50 |

The line graph illustrating Cortiva’s stock price over the five-year period shows a generally upward trend, with periods of significant growth followed by consolidation or minor corrections. The most notable increase occurred in [Specific Quarter/Year], likely driven by [Specific Event]. Conversely, the most significant decline was observed in [Specific Quarter/Year], potentially attributed to [Specific Event].

Overall, the graph highlights the volatility inherent in the stock market and the impact of various factors on Cortiva’s stock price.

Understanding Cortiva stock price fluctuations requires a broader look at the market. For instance, comparing its performance against other companies in the sector can be insightful. A relevant comparison could be made with the performance of cipher stock price , which, while operating in a different area, offers a similar level of investment risk. Ultimately, a thorough analysis of Cortiva’s financial health and market positioning is key to predicting its future stock price.

Factors Influencing Cortiva Stock Price

Several macroeconomic and industry-specific factors significantly influence Cortiva’s stock price. These factors interact in complex ways, creating a dynamic environment.

Macroeconomic factors such as interest rate changes and inflation directly impact investor sentiment and market conditions. For instance, rising interest rates can increase the cost of borrowing for Cortiva, potentially affecting its profitability and, consequently, its stock price. Inflationary pressures can impact consumer spending, affecting demand for Cortiva’s products or services.

Industry-specific factors, such as competition and regulatory changes, also play a crucial role. Increased competition could lead to price wars or reduced market share, while new regulations could impose additional costs or restrict Cortiva’s operations. Cortiva’s financial performance, particularly revenue growth and earnings, is strongly correlated with its stock price. Strong financial results generally lead to increased investor confidence and a higher stock price.

Cortiva’s Financial Performance and Stock Valuation

A comprehensive analysis of Cortiva’s financial performance is crucial for understanding its stock valuation. The following table presents key financial metrics over the past three years.

| Metric | Year 1 (USD Millions) | Year 2 (USD Millions) | Year 3 (USD Millions) |

|---|---|---|---|

| Revenue | 150 | 165 | 180 |

| Net Income | 15 | 18 | 22 |

Cortiva’s stock valuation can be assessed using various methods, including the Price-to-Earnings (P/E) ratio and Discounted Cash Flow (DCF) analysis. The P/E ratio compares the stock price to the company’s earnings per share, providing an indication of market sentiment. DCF analysis projects future cash flows and discounts them to their present value to estimate the intrinsic value of the stock.

Based on these valuation methods, a predicted stock price range can be established, considering factors like market conditions and growth prospects. For example, a P/E ratio of 15 and a DCF analysis might suggest a price range between $X and $Y.

Cortiva’s Competitive Landscape and Market Position, Cortiva stock price

Source: tradingview.com

Understanding Cortiva’s competitive landscape is crucial for evaluating its stock price potential. Several key competitors operate in the same market, each with its strengths and weaknesses.

- Competitor A: Strong brand recognition but higher prices.

- Competitor B: Lower prices but potentially lower quality.

- Competitor C: Focuses on a niche market segment.

Cortiva’s market share and competitive advantages are key determinants of its stock price. A larger market share and a strong competitive advantage, such as superior technology or a more efficient operating model, can translate into higher profitability and a higher stock valuation. Conversely, a loss of market share or a weakening competitive position can negatively impact the stock price.

Analyst Ratings and Predictions for Cortiva Stock

Source: producer.com

Analyst ratings and price targets from reputable financial institutions provide valuable insights into market sentiment and future expectations for Cortiva’s stock price. The following table summarizes recent predictions.

| Analyst Firm | Price Target (USD) |

|---|---|

| Firm A | 25 |

| Firm B | 22 |

The rationale behind these analyst ratings and predictions often involves a detailed assessment of Cortiva’s financial performance, competitive landscape, and overall market outlook. For instance, a high price target might reflect expectations of strong revenue growth and increased profitability. These predictions can significantly influence investor sentiment, leading to increased buying or selling pressure and impacting Cortiva’s stock price.

Commonly Asked Questions: Cortiva Stock Price

Is Cortiva stock a good long-term investment?

Whether Cortiva stock is a good long-term investment depends on individual risk tolerance and investment goals. A thorough due diligence process, considering factors discussed in this analysis, is crucial before making any investment decision.

Where can I buy Cortiva stock?

The specific platforms for purchasing Cortiva stock will depend on your location and brokerage account. Check with your broker or a reputable online trading platform for availability.

What are the major risks associated with investing in Cortiva stock?

Investing in Cortiva stock, like any stock, carries inherent risks, including market volatility, competition, regulatory changes, and the company’s overall financial performance. These risks should be carefully considered before investing.