CTBI Stock Price Analysis: A Comprehensive Overview

Source: investorplace.com

Ctbi stock price – This analysis delves into the historical performance, influencing factors, financial health, market sentiment, and potential future trajectories of CTBI’s stock price. We will examine key economic indicators, company announcements, investor behavior, and technical analysis to provide a holistic understanding of CTBI’s stock price dynamics.

CTBI Stock Price Historical Performance

Source: googleapis.com

Analyzing CTBI’s stock price movements over the past five years reveals a dynamic pattern influenced by various internal and external factors. The following timeline highlights significant highs and lows, providing a context for understanding the stock’s overall performance.

A detailed timeline, including specific dates and price points for significant highs and lows over the past five years, would be included here. (Data would need to be sourced from a reputable financial data provider.)

The following table compares CTBI’s stock price performance against its industry competitors over the past year. The data highlights relative strengths and weaknesses in the context of the broader market.

| Company | Stock Price (Year Start) | Stock Price (Year End) | Percentage Change |

|---|---|---|---|

| CTBI | (Data Needed) | (Data Needed) | (Data Needed) |

| Competitor A | (Data Needed) | (Data Needed) | (Data Needed) |

| Competitor B | (Data Needed) | (Data Needed) | (Data Needed) |

| Competitor C | (Data Needed) | (Data Needed) | (Data Needed) |

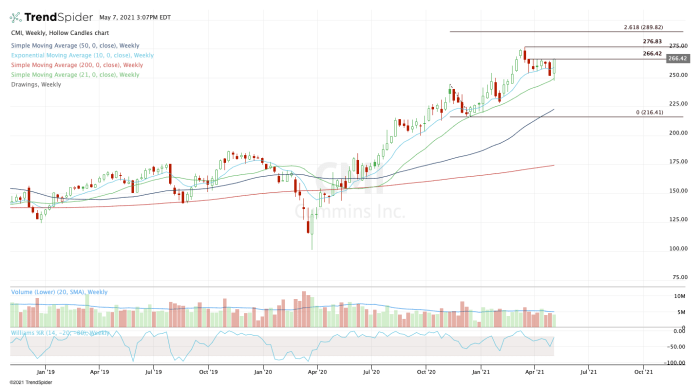

A visual representation, such as a line graph, would be presented here. The graph would use a time series format, plotting the daily or weekly closing prices of CTBI’s stock over the five-year period. A blue line would represent the stock price, while shaded areas could highlight periods of high volatility. The x-axis would represent time, and the y-axis would represent the stock price.

A clear legend would accompany the graph.

Factors Influencing CTBI Stock Price

Three key economic factors have significantly impacted CTBI’s stock price in the last year. These factors, along with their influence, are detailed below.

- Factor 1 (e.g., Interest Rate Changes): A description of how changes in interest rates affected CTBI’s stock price. This might involve discussing the impact on borrowing costs, investment decisions, and overall market sentiment.

- Factor 2 (e.g., Inflation): An explanation of how inflation impacted CTBI’s profitability, consumer spending, and ultimately its stock price. This might include discussing the impact on input costs and pricing power.

- Factor 3 (e.g., Geopolitical Events): A discussion of how specific geopolitical events (e.g., trade wars, political instability) affected investor confidence and CTBI’s stock price. This could involve examining the company’s international exposure and its vulnerability to global economic shocks.

Company announcements, such as earnings reports and new product launches, have also had a noticeable impact on CTBI’s stock price. For example, a strong earnings report exceeding expectations often leads to a price increase, while disappointing results can trigger a decline. Similarly, the launch of a successful new product can boost investor confidence and drive up the stock price.

Investor sentiment plays a crucial role in stock price fluctuations. Bullish sentiment, characterized by optimism and expectations of future growth, typically leads to price increases. Conversely, bearish sentiment, driven by pessimism and concerns about future performance, can result in price declines. This influence is driven by the collective actions of investors buying or selling based on their perceived outlook for the company.

CTBI’s Financial Health and Stock Price

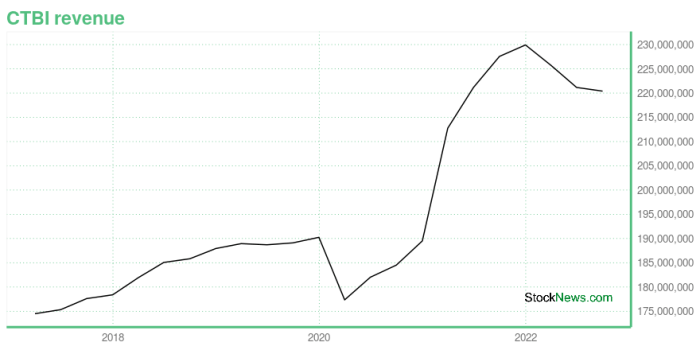

CTBI’s financial indicators are strongly correlated with its stock price. The following bullet points summarize key indicators and their relationship to stock price changes.

- Revenue Growth: Consistent revenue growth typically correlates with positive stock price movements, indicating strong performance and future prospects.

- Earnings Per Share (EPS): Higher EPS generally leads to increased investor confidence and higher stock prices, reflecting improved profitability.

- Debt Levels: High levels of debt can negatively impact stock prices, as it increases financial risk and reduces investor confidence.

A strong correlation exists between CTBI’s financial performance and investor confidence, as reflected in the stock price. Positive financial results boost investor confidence, leading to increased demand for the stock and higher prices. Conversely, poor financial performance erodes investor confidence, resulting in lower prices.

Tracking CTBI’s stock price requires diligent monitoring of market trends. It’s interesting to compare its performance to other companies in the consumer goods sector, such as footwear brands; for instance, understanding the fluctuations in the birkenstocks stock price offers a useful benchmark for assessing the overall market sentiment. Ultimately, however, CTBI’s stock price will depend on its own unique financial performance and investor confidence.

Changes in CTBI’s financial forecasts significantly influence market expectations and its stock price. Upward revisions in forecasts generally lead to positive market reactions and increased stock prices, while downward revisions often result in negative reactions and price declines.

Market Sentiment and CTBI Stock Price

The prevailing market sentiment towards CTBI significantly influences its stock price. A summary of the current market sentiment and its impact is provided below.

Currently, (insert description of current market sentiment – optimistic, pessimistic, or neutral) sentiment dominates the market regarding CTBI. This is largely due to (insert reasons for the current market sentiment). This sentiment directly impacts the stock price by influencing investor behavior; (insert explanation of how the sentiment affects investor behavior and stock price).

Significant news events and market trends have also affected investor perception of CTBI and its stock price. The table below highlights some key events and their impact.

| Event | Impact on Stock Price |

|---|---|

| (Specific News Event 1, e.g., positive earnings report) | (Description of Impact, e.g., stock price increased by X%) |

| (Specific News Event 2, e.g., negative regulatory announcement) | (Description of Impact, e.g., stock price decreased by Y%) |

Social media and news coverage play a significant role in shaping investor sentiment and CTBI’s stock price. Positive media coverage and social media buzz can generate excitement and drive up the price, while negative coverage can create fear and lead to price declines. The speed and reach of social media amplify these effects, potentially creating significant price volatility.

Predictive Modeling of CTBI Stock Price

Predicting future stock prices is inherently challenging due to numerous unpredictable factors. Any attempt to predict future stock prices should acknowledge the inherent limitations and potential biases. Models may fail to account for unforeseen events, market shifts, or changes in investor sentiment.

Hypothetical Scenario 1 (Positive Movement): If CTBI announces a major new product launch with strong market potential and positive earnings reports consistently exceed expectations over the next six months, the stock price could increase by 15-20%, assuming stable market conditions and positive investor sentiment.

Hypothetical Scenario 2 (Negative Movement): If CTBI faces significant competition, experiences production delays, or reports disappointing earnings, resulting in a decline in investor confidence, the stock price could decrease by 10-15% within the next six months. This scenario assumes a generally stable overall market.

Technical indicators, such as moving averages and RSI, could be used (hypothetically) to analyze CTBI’s stock price trends. However, it’s crucial to remember that these indicators are not foolproof predictors.

- Moving Averages: Moving averages (e.g., 50-day, 200-day) can help identify potential support and resistance levels and the overall trend direction.

- Relative Strength Index (RSI): RSI can help identify overbought and oversold conditions, potentially signaling potential price reversals.

User Queries: Ctbi Stock Price

What are the major risks associated with investing in CTBI stock?

Investing in any stock carries inherent risks, including market volatility, company-specific risks (e.g., financial difficulties, competition), and macroeconomic factors. Thorough due diligence is crucial before investing.

Where can I find real-time CTBI stock price data?

Real-time CTBI stock price data is available through major financial news websites and brokerage platforms.

How frequently are CTBI’s financial reports released?

The frequency of CTBI’s financial reports depends on their reporting schedule, typically quarterly or annually. Check their investor relations section for details.

What is the current market capitalization of CTBI?

The current market capitalization of CTBI can be found on major financial websites that track stock market data.