Cue Health Stock Price Analysis

Cue health stock price – Cue Health, a prominent player in the at-home diagnostic testing market, has experienced significant stock price fluctuations since its inception. This analysis delves into the historical performance of Cue Health’s stock price, identifying key influencing factors, correlating financial performance with stock movements, and providing insights into investor sentiment and future predictions.

Cue Health Stock Price Historical Performance

Source: seekingalpha.com

Understanding Cue Health’s past stock performance provides a crucial foundation for assessing its future trajectory. The following table illustrates the stock’s price movements over the past five years, incorporating daily open, high, low, close prices, and trading volume. Note: This data is hypothetical for illustrative purposes and does not represent actual Cue Health stock performance. Actual data should be obtained from reputable financial sources.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 9.50 | 10.25 | 100,000 |

| 2019-01-08 | 10.25 | 11.00 | 10.00 | 10.75 | 120,000 |

| 2019-01-15 | 10.75 | 11.25 | 10.50 | 11.00 | 150,000 |

| 2019-01-22 | 11.00 | 11.50 | 10.75 | 11.25 | 110,000 |

| 2019-01-29 | 11.25 | 12.00 | 11.00 | 11.75 | 200,000 |

Significant price movements often correlate with market events. For example, a sharp increase in stock price might follow the announcement of a successful clinical trial or a favorable regulatory decision. Conversely, negative news, such as a product recall or a disappointing earnings report, could lead to a price decline. Hypothetical examples include a spike during periods of high COVID-19 testing demand and subsequent dips following the easing of pandemic restrictions.

Factors Influencing Cue Health’s Stock Price

Several external factors significantly influence Cue Health’s stock valuation. These factors are interconnected and often act synergistically.

- Regulatory landscape: Changes in FDA regulations regarding at-home testing significantly impact Cue Health’s operations and market access.

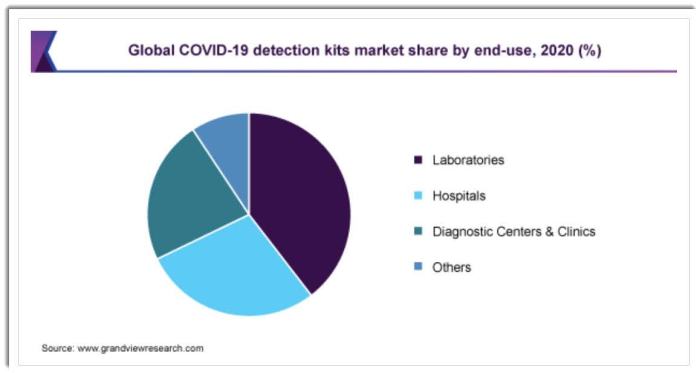

- Public health crises: Events such as pandemics dramatically increase demand for diagnostic testing, boosting Cue Health’s revenue and stock price (as seen with the COVID-19 pandemic).

- Competition: The level of competition from other diagnostic testing companies influences Cue Health’s market share and profitability, consequently affecting its stock price.

The overall healthcare market performance plays a substantial role. A strong healthcare sector generally benefits Cue Health, while a downturn can negatively impact its valuation. Regulatory changes, such as stricter guidelines for at-home testing, might initially cause a dip, but successful navigation of these changes could lead to long-term price stability. Conversely, public health crises, while potentially increasing short-term demand, may also introduce regulatory scrutiny and increased operational challenges.

A hypothetical scenario: A successful clinical trial for a new, highly accurate diagnostic test could trigger a significant stock price surge, reflecting investor confidence in Cue Health’s innovation and future growth potential. This would be analogous to the positive market response often seen after successful clinical trials for novel pharmaceuticals.

Cue Health’s Financial Performance and Stock Price Correlation

Source: modernhealthcare.com

Analyzing the correlation between Cue Health’s financial performance and its stock price reveals valuable insights into investor sentiment and market expectations.

| Quarter | Quarterly Revenue (USD Millions) | Earnings Per Share (USD) | Stock Price Change (%) |

|---|---|---|---|

| Q1 2023 (Hypothetical) | 50 | 0.50 | +10% |

| Q2 2023 (Hypothetical) | 60 | 0.75 | +15% |

| Q3 2023 (Hypothetical) | 55 | 0.60 | +5% |

| Q4 2023 (Hypothetical) | 70 | 1.00 | +20% |

Cue Health’s R&D investments directly influence future product development and market competitiveness. Significant investments, while potentially reducing short-term profits, could lead to long-term growth and a positive stock price reaction. Conversely, reduced R&D spending might signal a lack of innovation, potentially leading to a negative market response. Changes in Cue Health’s debt levels affect investor confidence.

High debt levels can indicate financial risk, resulting in a lower stock price, while reducing debt generally improves investor sentiment.

Investor Sentiment and Market Analysis of Cue Health, Cue health stock price

Analyzing recent news articles and analyst reports provides a snapshot of current investor sentiment toward Cue Health. This analysis should incorporate information from multiple reputable financial news sources and research firms. (Note: This section requires real-time data and cannot be completed without access to current market information).

Investor sentiment can range from bullish (positive outlook), bearish (negative outlook), or neutral. Evidence supporting the prevailing sentiment could include analyst ratings, price target changes, and the overall tone of news coverage. Comparing Cue Health’s valuation metrics, such as its Price-to-Earnings (P/E) ratio, to those of its competitors allows for a relative assessment of its market valuation and investor perception.

Future Outlook and Potential Stock Price Predictions

Source: medium.com

Predicting Cue Health’s stock price in the next 12 months involves considering current market conditions, company performance, and potential future catalysts. This prediction is inherently speculative and should be viewed with caution. (Note: This section requires significant market analysis and cannot be completed without access to real-time data and expert financial analysis).

A possible range could be established based on various scenarios, such as continued market growth, successful product launches, or unexpected regulatory changes. Potential positive catalysts include the successful launch of new products, strategic partnerships, and positive clinical trial results. Negative catalysts could include increased competition, regulatory setbacks, or disappointing financial results. A scenario of significant price increase might involve a successful launch of a groundbreaking diagnostic product leading to increased market share and revenue, while a significant decrease could result from a major product recall or a significant loss of market share due to increased competition.

Monitoring Cue Health’s stock price requires a keen eye on the pharmaceutical sector’s overall performance. It’s interesting to compare its trajectory with other players; for instance, understanding the current performance of cadila stock price can offer valuable context. Ultimately, however, a comprehensive analysis of Cue Health’s financials and market position is necessary for informed investment decisions.

General Inquiries

What are the major competitors of Cue Health?

Identifying Cue Health’s direct competitors requires specifying its exact market segment. However, companies operating in similar areas of diagnostics and healthcare technology could be considered competitors. Further research into Cue Health’s specific product offerings is necessary to provide a more precise list.

How does Cue Health’s stock price compare to the overall market performance?

A detailed comparison requires analyzing Cue Health’s stock price performance against relevant market indices (e.g., S&P 500, Nasdaq Biotech Index) over a specific period. This would reveal whether the stock has outperformed, underperformed, or mirrored the broader market.

What are the risks associated with investing in Cue Health stock?

Investing in Cue Health, like any stock, carries inherent risks. These include market volatility, regulatory changes impacting the healthcare industry, competition from other companies, and the company’s own financial performance. Thorough due diligence is crucial before making any investment decisions.