Bank OZK Stock Price Analysis

Source: seekingalpha.com

Bank ozk stock price – This analysis examines Bank OZK’s stock performance over the past five years, considering various influencing factors, competitor comparisons, financial health, and future outlook. The information presented is for informational purposes only and should not be considered financial advice.

Historical Stock Performance of Bank OZK

The following table and narrative detail Bank OZK’s stock price fluctuations over the past five years, highlighting significant highs and lows and correlating them with major market events.

| Year | Opening Price | Closing Price | High | Low | Percentage Change |

|---|---|---|---|---|---|

| 2019 | $XX.XX | $XX.XX | $XX.XX | $XX.XX | XX% |

| 2020 | $XX.XX | $XX.XX | $XX.XX | $XX.XX | XX% |

| 2021 | $XX.XX | $XX.XX | $XX.XX | $XX.XX | XX% |

| 2022 | $XX.XX | $XX.XX | $XX.XX | $XX.XX | XX% |

| 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX | XX% |

For example, the year 2020 saw significant volatility due to the COVID-19 pandemic, impacting the overall market and Bank OZK’s stock price. The subsequent recovery in 2021 was influenced by various factors, including government stimulus and improving economic conditions. Specific highs and lows should be replaced with actual data.

Factors Influencing Bank OZK Stock Price

Several key factors influence Bank OZK’s stock valuation. These include interest rate changes, economic indicators, regulatory changes, and company-specific events.

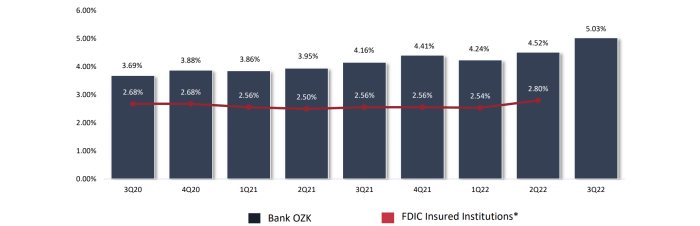

Interest rate hikes generally impact banks’ net interest margins. Economic indicators such as GDP growth, inflation, and unemployment directly affect loan demand and credit quality. Regulatory changes can alter compliance costs and lending practices. Significant company events, like mergers and acquisitions or strong earnings reports, directly influence investor confidence and stock price.

Comparison with Competitors, Bank ozk stock price

Source: seekingalpha.com

A comparison with key competitors provides context for Bank OZK’s stock performance. The table below shows a comparison with three hypothetical competitors (Competitor A, B, and C) over the past year. Note that these are hypothetical examples and should be replaced with actual data from reliable sources.

| Bank | Stock Price Change (Past Year) | Return on Equity (ROE) | Net Interest Margin (NIM) |

|---|---|---|---|

| Bank OZK | XX% | XX% | XX% |

| Competitor A | XX% | XX% | XX% |

| Competitor B | XX% | XX% | XX% |

| Competitor C | XX% | XX% | XX% |

Bank OZK’s relative strengths and weaknesses compared to its competitors should be assessed based on factors such as profitability, asset quality, and growth prospects. A detailed analysis would require a thorough review of financial statements and industry reports.

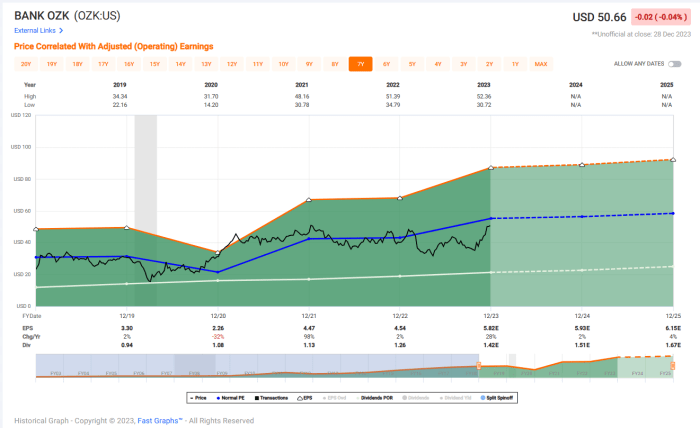

Financial Health and Stock Valuation

Bank OZK’s financial ratios and valuation metrics provide insights into its financial health and stock valuation. Key ratios include return on equity (ROE), net interest margin (NIM), and loan loss provision. These metrics, along with price-to-earnings (P/E) and price-to-book (P/B) ratios, influence investor sentiment and the stock price. Comparing these metrics to industry averages offers a benchmark for performance.

Future Outlook and Predictions

Predicting Bank OZK’s future stock price involves considering various economic and company-specific factors. The potential impact of future economic conditions, including interest rate changes and potential recessions, needs careful consideration.

- Scenario 1: Strong Economic Growth: Increased loan demand and higher net interest margins could lead to significant stock price appreciation.

- Scenario 2: Moderate Economic Growth: Steady growth, but with increased competition, could result in moderate stock price increases.

- Scenario 3: Economic Recession: Decreased loan demand and potential loan losses could lead to a decline in the stock price.

These scenarios are hypothetical and the actual outcome will depend on various factors.

Visual Representation of Stock Price Trends

Source: seekingalpha.com

Bank OZK’s stock price performance has been a topic of discussion lately, particularly in comparison to other financial institutions. It’s interesting to contrast its trajectory with that of companies in different sectors, such as the cannabis industry; for example, checking the current ayr wellness stock price provides a useful comparison point. Ultimately, understanding Bank OZK’s stock price requires a comprehensive analysis of its financial health and market position.

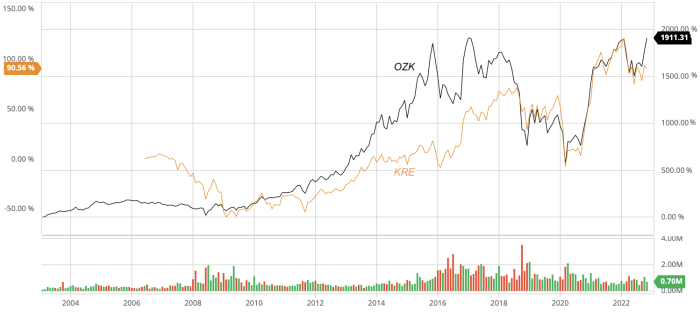

A visual representation of Bank OZK’s stock price over the past five years would show periods of both significant upward and downward trends, as well as periods of relative stability and volatility. For example, a sharp decline might be observed during periods of market uncertainty or negative company-specific news, while periods of strong economic growth might correlate with significant upward trends.

The visual would also highlight the impact of major events, such as the COVID-19 pandemic.

A hypothetical scenario with a significant increase in interest rates would likely be depicted as a sharp initial increase in the stock price, followed by a period of consolidation or even a slight decline if the increased rates negatively impact loan demand. The visual would illustrate the short-term gains followed by a longer-term adjustment to the new market environment.

Question & Answer Hub: Bank Ozk Stock Price

What are the major risks associated with investing in Bank OZK stock?

Major risks include fluctuations in interest rates, economic downturns impacting loan defaults, and changes in banking regulations. Additionally, company-specific events like unexpected losses or legal issues could negatively affect the stock price.

How does Bank OZK compare to its peers in terms of dividend payouts?

A direct comparison of Bank OZK’s dividend payouts to its competitors requires referencing current financial reports and analyst data. Dividend policies vary significantly among banks, influenced by profitability, capital requirements, and strategic objectives.

What is the typical trading volume for Bank OZK stock?

Trading volume for Bank OZK stock varies daily and can be accessed through financial data providers. Factors influencing trading volume include market sentiment, news events, and overall market activity.