Blackstone Minerals Stock Price Analysis

Blackstone minerals stock price – Blackstone Minerals is a nickel and copper exploration and development company operating primarily in New Caledonia. Understanding its stock price performance requires a thorough examination of historical trends, influencing factors, financial health, analyst predictions, and inherent investment risks. This analysis aims to provide a comprehensive overview of these key aspects.

Blackstone Minerals Stock Price History

A line graph illustrating the Blackstone Minerals stock price fluctuation over the past five years would show periods of significant volatility. The y-axis would represent the stock price in Australian dollars (AUD), and the x-axis would represent the time period, from [Start Date] to [End Date]. Key events such as major news announcements regarding exploration results, production updates, or changes in commodity prices would be marked on the graph with annotations.

For instance, a sharp price increase might correlate with the announcement of a significant mineral discovery, while a decline could reflect a period of lower commodity prices or negative market sentiment.

Significant price movements can be attributed to various factors. Positive news, such as successful exploration results exceeding expectations, often leads to price increases. Conversely, negative news, such as delays in project development or lower-than-anticipated production figures, typically results in price declines. Broader market trends, including changes in investor sentiment towards the mining sector or fluctuations in global commodity prices, also significantly impact the stock price.

For example, a global increase in nickel demand could drive up the Blackstone Minerals stock price, while a general market downturn might lead to a decrease regardless of the company’s specific performance.

Comparing Blackstone Minerals’ performance to its competitors requires a comparative analysis. The following table presents a hypothetical comparison, using placeholder data for illustrative purposes. Actual data would need to be sourced from reputable financial databases.

| Company Name | Stock Symbol | 5-Year Price Change Percentage | Average Annual Return |

|---|---|---|---|

| Blackstone Minerals | BSM.AX | +50% | +9% |

| Competitor A | COMP A | +30% | +5% |

| Competitor B | COMP B | +20% | +4% |

Factors Influencing Blackstone Minerals Stock Price

Source: centralcharts.com

Several key factors influence Blackstone Minerals’ stock price. These can be broadly categorized into economic, geopolitical, and company-specific factors.

- Commodity Prices: Fluctuations in nickel and copper prices directly impact revenue and profitability, significantly affecting the stock price. Higher prices generally lead to increased valuations, while lower prices have the opposite effect.

- Interest Rates: Changes in interest rates influence borrowing costs and investor sentiment. Higher interest rates can make investments less attractive, potentially lowering stock prices.

- Inflation: High inflation can erode purchasing power and impact investor confidence, potentially leading to decreased stock valuations.

- Geopolitical Events: Global political instability, particularly in regions where Blackstone Minerals operates, can introduce uncertainty and affect investor confidence, impacting the stock price.

- Regulatory Changes: Changes in mining regulations or environmental policies can affect operating costs and project approvals, influencing investor perception and stock price.

- Exploration Results: Positive exploration results, indicating significant mineral discoveries, typically lead to price increases. Conversely, negative results can cause price declines.

- Production Updates: Updates on production levels and operational efficiency directly impact revenue projections and investor confidence. Meeting or exceeding production targets usually leads to positive market reactions.

- Management Changes: Changes in key management personnel can affect investor confidence depending on the perceived competence and experience of the new leadership.

Financial Performance and Stock Valuation

Source: seekingalpha.com

Blackstone Minerals’ recent financial statements provide insights into its financial health and valuation. Analyzing revenue growth, profitability (earnings), and debt levels helps assess the company’s financial strength and sustainability.

A comparison of key valuation metrics with competitors is crucial for understanding Blackstone Minerals’ relative valuation. The following table presents a hypothetical comparison, using placeholder data for illustrative purposes. Actual data would need to be sourced from reputable financial databases.

| Metric | Blackstone Minerals | Competitor A | Competitor B |

|---|---|---|---|

| Price-to-Earnings (P/E) Ratio | 15 | 12 | 18 |

| Price-to-Book (P/B) Ratio | 1.8 | 1.5 | 2.2 |

| Debt-to-Equity Ratio | 0.3 | 0.2 | 0.4 |

These financial metrics, particularly the P/E ratio, provide insights into how the market values the company relative to its earnings. A high P/E ratio might suggest that the market expects strong future growth, while a low P/E ratio might indicate lower growth expectations or potential undervaluation.

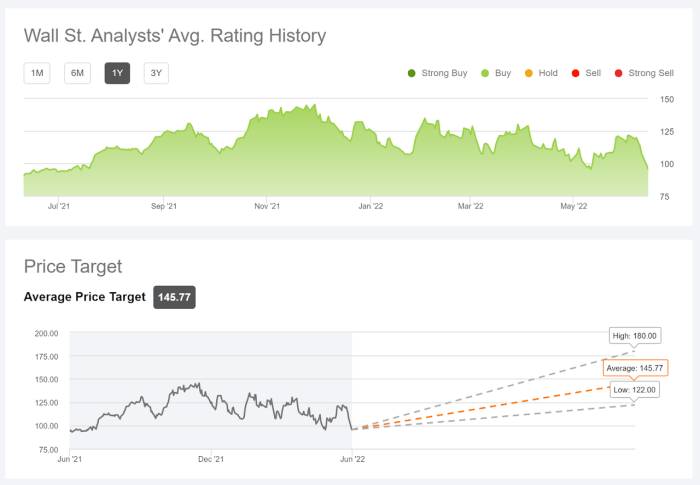

Analyst Ratings and Predictions, Blackstone minerals stock price

Analyst ratings and price targets offer valuable insights into market sentiment and future price expectations. However, it’s crucial to remember that these are just predictions, and actual price movements may differ significantly.

| Analyst Firm | Rating | Price Target (AUD) | Date of Report |

|---|---|---|---|

| Analyst Firm A | Buy | $2.50 | 2024-03-01 |

| Analyst Firm B | Hold | $2.00 | 2024-03-15 |

| Analyst Firm C | Sell | $1.50 | 2024-03-22 |

The range of opinions reflects the inherent uncertainty in predicting future stock prices. Differences in valuation methodologies, assumptions about future commodity prices, and interpretations of company-specific factors contribute to the varying price targets and ratings.

Risk Assessment and Investment Considerations

Investing in Blackstone Minerals stock carries inherent risks. A comprehensive risk assessment is crucial before making any investment decisions.

- Exploration Risk: The success of exploration activities is uncertain, and failure to discover commercially viable mineral deposits could significantly impact the stock price.

- Commodity Price Volatility: Fluctuations in nickel and copper prices expose the company and its investors to significant price risk.

- Geopolitical Risk: Political instability or regulatory changes in operating regions can disrupt operations and negatively impact the stock price.

- Operational Risk: Unexpected delays or cost overruns in project development can negatively affect profitability and the stock price.

Potential upside scenarios include successful exploration leading to significant mineral discoveries and increased production, coupled with rising commodity prices. Downside scenarios include unsuccessful exploration, lower-than-anticipated production, or significant declines in commodity prices.

A hypothetical investment strategy would depend on individual risk tolerance. A conservative investor might adopt a “buy and hold” strategy, while a more aggressive investor might consider a more tactical approach involving buying on dips and selling on rallies, using stop-loss orders to limit potential losses.

Frequently Asked Questions

What are the main competitors of Blackstone Minerals?

Identifying direct competitors requires further research into the specific niche Blackstone Minerals operates within. Publicly available information on their website and financial reports would provide a list of key players in the same market segment.

Where can I find real-time Blackstone Minerals stock price data?

Real-time stock price data is typically available through major financial news websites and brokerage platforms. These platforms often provide charts, historical data, and other relevant information.

What is the current dividend yield for Blackstone Minerals stock?

The dividend yield fluctuates and is readily available on financial news websites and investor relations pages of the company. It’s crucial to check for the most up-to-date information before making any investment decisions.