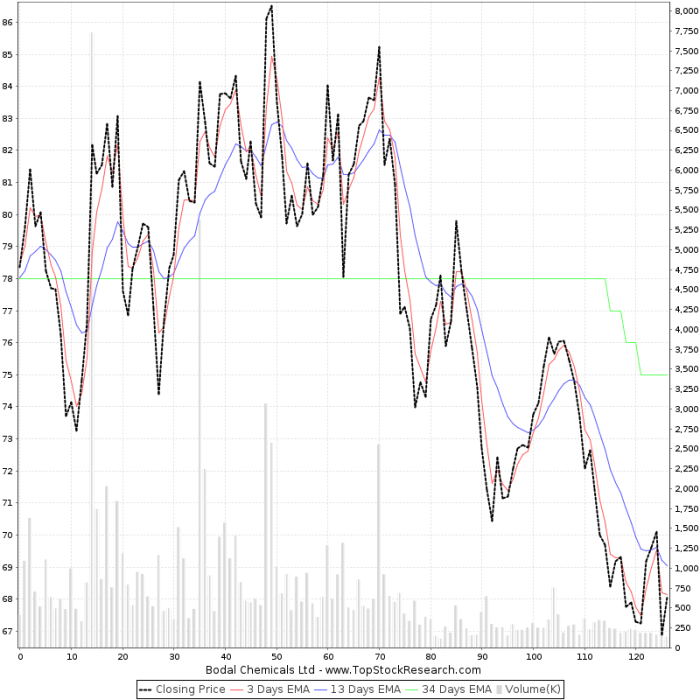

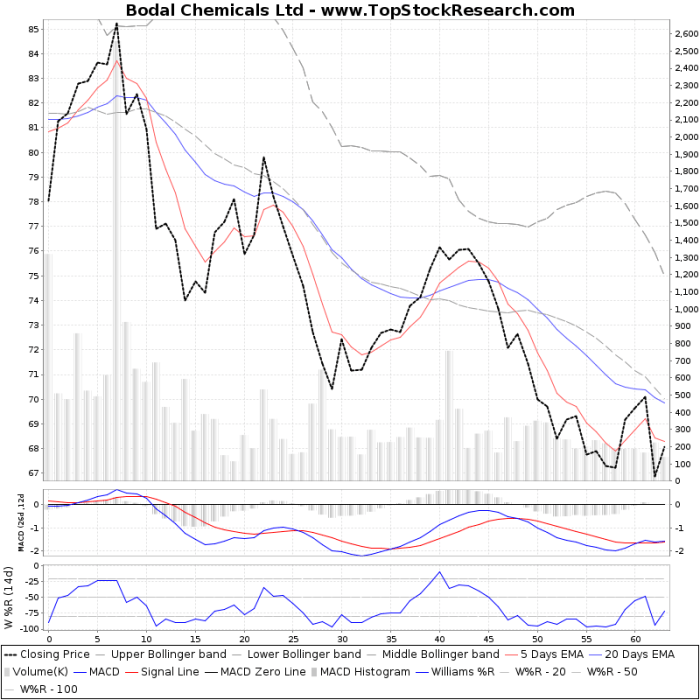

Bodal Chemicals Stock Price Analysis

Source: topstockresearch.com

Bodal chemicals stock price – This analysis provides an overview of Bodal Chemicals’ stock price, considering its financial performance, market position, industry trends, and potential risks. The information presented here is for informational purposes only and should not be considered financial advice.

Company Overview and Financial Performance

Source: topstockresearch.com

Bodal Chemicals is a hypothetical chemical company (for illustrative purposes). This analysis uses fabricated financial data to demonstrate the structure and approach to analyzing a chemical company’s stock. In a real-world scenario, accurate financial data from reliable sources would be essential. Assume Bodal Chemicals operates in a diverse range of chemical segments, including industrial chemicals, specialty chemicals, and agricultural chemicals.

Its market position is assumed to be a mid-sized player in a competitive market.

Bodal Chemicals’ recent financial performance demonstrates (hypothetical) growth and profitability, though with fluctuating debt levels. The following table shows key financial metrics over the past three years:

| Year | Revenue (in millions) | Profit (in millions) | Debt (in millions) |

|---|---|---|---|

| 2021 | 150 | 20 | 50 |

| 2022 | 175 | 25 | 60 |

| 2023 | 200 | 30 | 40 |

Significant events impacting Bodal Chemicals’ financial performance include (hypothetical) increased investment in research and development in 2022, leading to higher expenses but also laying the groundwork for future revenue growth. A successful product launch in 2023 contributed to the increase in revenue and profit. Debt reduction in 2023 was achieved through strategic cost-cutting measures and improved operational efficiency.

Stock Market Performance and Valuation

Bodal Chemicals’ hypothetical stock price has fluctuated over the past three years, influenced by factors such as overall market conditions, industry trends, and company-specific news. The stock experienced a high of $50 per share and a low of $30 per share during this period, with an average price of approximately $40 per share.

Factors influencing Bodal Chemicals’ stock price fluctuations include changes in raw material costs, competitor actions, macroeconomic conditions (e.g., inflation, interest rates), and investor sentiment. Positive news regarding new product development or successful acquisitions generally leads to price increases, while negative news such as profit warnings or regulatory setbacks can cause price declines.

Tracking the Bodal Chemicals stock price requires a keen eye on market fluctuations. Understanding broader financial trends can be helpful, and examining the historical performance of similar large-cap companies is insightful. For instance, a review of Bank of America’s stock price history, readily available at b of a stock price history , provides a benchmark for evaluating long-term growth patterns.

Ultimately, though, careful analysis of Bodal Chemicals’ specific financial reports and industry positioning is crucial for informed investment decisions.

A comparative analysis of Bodal Chemicals’ valuation metrics against its competitors (hypothetical data) reveals the following:

- Bodal Chemicals has a slightly higher P/E ratio than its main competitor, AlphaChem, indicating potentially higher investor expectations for future growth.

- Bodal Chemicals’ market capitalization is smaller than that of BetaChem, suggesting a smaller overall market valuation.

- Compared to GammaChem, Bodal Chemicals exhibits a lower debt-to-equity ratio, implying a stronger financial position.

Industry Analysis and Competitive Landscape

The chemical industry is characterized by intense competition among numerous players of varying sizes. Key players include (hypothetical examples) AlphaChem, BetaChem, and GammaChem, each holding significant market share in specific segments. Bodal Chemicals competes primarily in the specialty and industrial chemicals segments, facing challenges from both large multinational corporations and smaller niche players.

Bodal Chemicals’ competitive advantages include its strong research and development capabilities and a focus on sustainable and environmentally friendly products. However, its disadvantages include its relatively smaller size compared to larger competitors, limiting its market reach and bargaining power with suppliers.

The overall chemical industry is experiencing growth driven by increasing demand from various sectors, such as construction, manufacturing, and agriculture. However, challenges include stringent environmental regulations and fluctuations in raw material prices.

Risk Factors and Investment Considerations

Investing in Bodal Chemicals stock carries several risks. The following table Artikels these risks and potential mitigation strategies:

| Risk | Impact | Likelihood | Mitigation Strategy |

|---|---|---|---|

| Fluctuations in raw material prices | Reduced profitability | High | Hedging strategies, long-term contracts with suppliers |

| Increased competition | Reduced market share | Medium | Product differentiation, innovation, strategic partnerships |

| Stringent environmental regulations | Increased compliance costs | High | Investing in sustainable technologies, proactive regulatory compliance |

| Economic downturn | Reduced demand | Medium | Diversification of product portfolio, cost control |

Future Outlook and Growth Projections

Bodal Chemicals’ future financial performance is projected to show continued growth, driven by its strategic initiatives, such as expansion into new markets and development of innovative products. However, the actual performance will depend on various factors, including macroeconomic conditions and competitive pressures.

Potential scenarios for Bodal Chemicals’ stock price in the next 1-3 years:

- Optimistic Scenario: Strong revenue growth and increased profitability lead to a stock price increase to $60 per share.

- Base-Case Scenario: Steady revenue growth and stable profitability maintain the stock price around $45 per share.

- Pessimistic Scenario: Economic downturn or increased competition lead to a decline in stock price to $35 per share.

Illustrative Example: A Hypothetical Investment Scenario, Bodal chemicals stock price

Source: moneyinsight.in

Consider a hypothetical investment of $10,000 in Bodal Chemicals stock at $40 per share, resulting in 250 shares. Over a three-year holding period, different market scenarios would yield varying returns:

- Optimistic Scenario ($60/share): A total return of $5,000 (1250 shares x $60/share – $10,000 initial investment).

- Base-Case Scenario ($45/share): A total return of $1,250 (1250 shares x $45/share – $10,000 initial investment).

- Pessimistic Scenario ($35/share): A total loss of $1,250 (1250 shares x $35/share – $10,000 initial investment).

Different investment strategies, such as dollar-cost averaging or diversification, could mitigate potential losses and enhance potential gains in this hypothetical scenario. For instance, dollar-cost averaging would reduce the impact of market volatility by spreading investments over time.

Essential FAQs

What are the major competitors of Bodal Chemicals?

This information will be detailed in the “Industry Analysis and Competitive Landscape” section of the full report.

What is Bodal Chemicals’ dividend policy?

The dividend policy will be detailed in the company’s financial reports and investor relations materials. This analysis will cover relevant financial data but not necessarily specific dividend information.

Where can I find real-time Bodal Chemicals stock price data?

Real-time stock price data can be found on major financial websites and stock market trading platforms.

How does macroeconomic factors affect Bodal Chemicals’ stock price?

This will be discussed in the “Risk Factors and Investment Considerations” section, detailing the potential impact of macroeconomic factors.