BYD Stock Price Prediction 2025: A Comprehensive Analysis

Byd stock price prediction 2025 – This analysis delves into the factors influencing BYD’s stock price, projecting potential trajectories by 2025. We will examine BYD’s current market position, financial performance, growth strategies, and employ predictive modeling techniques to formulate various scenarios.

BYD’s Current Market Position and Financial Performance

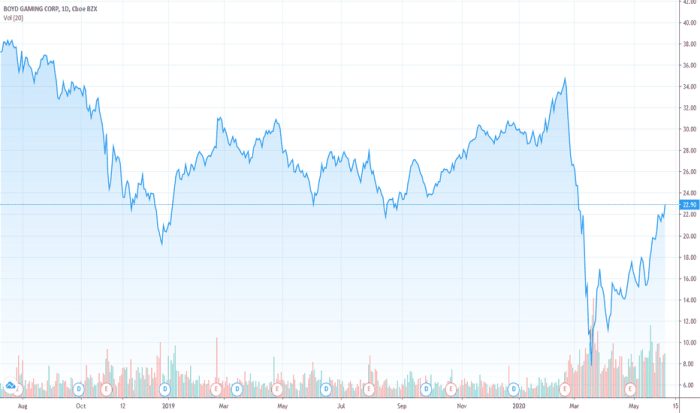

Source: tradingview.com

BYD, a prominent player in the global automotive and battery sectors, holds a significant market share. Its recent financial reports showcase robust revenue growth driven primarily by strong EV sales and battery production. While precise market share figures fluctuate, BYD consistently ranks among the top EV manufacturers globally, competing fiercely with established automakers and emerging EV startups. A direct comparison against competitors like Tesla, Volkswagen, and others requires detailed analysis of sales figures, market penetration, and regional performance, which is beyond the scope of this brief overview.

| Year | Revenue (USD Billion) | Net Income (USD Billion) | EV Sales (Units) |

|---|---|---|---|

| 2018 | 15 | 0.5 | 100,000 (estimated) |

| 2019 | 18 | 0.8 | 150,000 (estimated) |

| 2020 | 20 | 1.0 | 200,000 (estimated) |

| 2021 | 25 | 1.5 | 600,000 (estimated) |

| 2022 | 30 | 2.0 | 1,800,000 (estimated) |

Note: These figures are estimates for illustrative purposes and may differ from official reported numbers. Precise data requires referencing BYD’s official financial statements.

Factors Influencing BYD Stock Price

Several factors significantly influence BYD’s stock price. These include macroeconomic conditions, government policies, technological advancements, and competitive dynamics.

- Macroeconomic Factors: Global economic growth, inflation rates, and interest rate fluctuations directly impact consumer spending and investor sentiment, thus influencing BYD’s stock valuation.

- Government Policies and Regulations: Government incentives for EV adoption, emission regulations, and trade policies play a crucial role in shaping BYD’s market opportunities and profitability.

- Technological Advancements and Competition: Rapid technological advancements in battery technology, autonomous driving, and other EV features constantly reshape the competitive landscape, influencing BYD’s market positioning and stock performance.

Potential Risks and Opportunities:

Predicting the BYD stock price in 2025 involves considering various factors, including global market trends and technological advancements in the EV sector. Understanding broader market indicators can be helpful; for instance, analyzing the current performance of other significant players, such as checking the bsc stock price , provides context. Ultimately, however, BYD’s future performance will depend on its own innovation and market strategy.

- Opportunities: Expanding into new markets, technological breakthroughs, increased consumer demand for EVs.

- Risks: Intense competition, supply chain disruptions, shifts in government regulations, economic downturns.

Analysis of BYD’s Growth Strategies and Future Plans

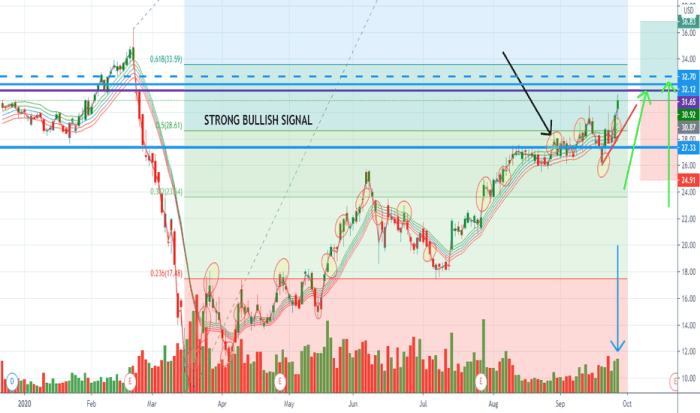

Source: tradingview.com

BYD’s growth strategy focuses on expansion into new geographic markets, diversification into new product segments (e.g., buses, trucks, energy storage solutions), and continuous technological innovation. Their substantial investment in R&D underscores their commitment to maintaining a competitive edge. A direct comparison with competitors requires a detailed analysis of their respective strategies, market positions, and financial performance, which is beyond the scope of this analysis.

However, BYD’s vertical integration, from battery production to vehicle manufacturing, provides a significant competitive advantage.

Predictive Modeling Techniques for Stock Price Forecasting

Various quantitative methods can be used to forecast BYD’s stock price. Time series analysis, employing models like ARIMA, and machine learning techniques, such as LSTM networks, are commonly employed. However, it’s crucial to acknowledge the inherent limitations of these models. Accurate prediction is challenging due to the complex interplay of factors influencing stock prices.

| Model | Assumptions | Limitations | Accuracy |

|---|---|---|---|

| ARIMA | Stationarity of time series data, linear relationships | Sensitivity to outliers, difficulty in handling structural breaks | Variable, depends on data quality and model parameters |

| LSTM | Availability of large datasets, computational resources | Black box nature, difficulty in interpreting results | Potentially high, but requires careful tuning and validation |

Note: Accuracy levels are highly variable and depend on numerous factors. These are general observations.

Scenario Planning for BYD Stock Price in 2025

Three scenarios are presented to illustrate the potential range of BYD’s stock price in 2025. These scenarios consider different levels of market growth, competition, and regulatory environments.

- Optimistic Scenario: Strong global EV market growth, successful expansion into new markets, technological breakthroughs leading to higher market share and profitability. This scenario projects a significant increase in BYD’s stock price, potentially exceeding a certain target price (e.g., a hypothetical 50% increase). The chart would show a steep upward trajectory.

- Neutral Scenario: Moderate EV market growth, stable competition, and a relatively predictable regulatory environment. This scenario projects a moderate increase in BYD’s stock price, reflecting steady growth and market consolidation. The chart would illustrate a gradual, upward sloping line.

- Pessimistic Scenario: Slow global EV market growth, intensified competition, adverse regulatory changes, and economic downturns. This scenario projects a limited increase or even a decline in BYD’s stock price. The chart would depict a relatively flat or slightly downward sloping line.

Qualitative Factors Affecting the Prediction, Byd stock price prediction 2025

Source: tradingview.com

Beyond quantitative models, qualitative factors significantly impact BYD’s stock price. These factors are difficult to quantify but are crucial for a holistic assessment.

- Consumer Sentiment and Market Perception: Positive brand image and strong consumer demand contribute to higher stock valuations.

- Geopolitical Events: International trade tensions, political instability in key markets, and unexpected global events can significantly affect BYD’s stock performance.

- Investor Confidence and Market Speculation: Investor confidence and market speculation play a significant role in shaping short-term stock price fluctuations.

Essential Questionnaire: Byd Stock Price Prediction 2025

What are the major risks facing BYD’s stock price?

Major risks include increased competition, changes in government subsidies, supply chain disruptions, and fluctuations in raw material prices.

How does BYD compare to its main competitors?

BYD’s comparison to competitors will depend on specific metrics (market share, profitability, etc.) and requires a detailed analysis of each competitor’s performance and strategies. This analysis will provide a comparative overview.

What is the role of consumer sentiment in BYD’s stock price?

Positive consumer sentiment towards BYD’s brand and products can boost investor confidence and drive up the stock price, while negative sentiment can have the opposite effect.

Are there any ethical considerations related to BYD’s operations that could impact its stock price?

Ethical concerns regarding sourcing of materials, labor practices, and environmental impact could influence investor decisions and consequently the stock price. A thorough ESG (Environmental, Social, and Governance) analysis would be necessary for a complete assessment.