Cerebral Stock Price Analysis

Cerebral stock price – This analysis delves into the historical performance, influencing factors, investor sentiment, future predictions, and risk assessment of Cerebral’s stock price. We will examine key events, financial indicators, and market dynamics to provide a comprehensive overview.

Historical Stock Performance of Cerebral, Cerebral stock price

Tracking Cerebral’s stock price requires considering its timeline since its equivalent to an IPO (assuming it’s not publicly traded via a traditional IPO, the analysis would use a relevant benchmark date like a significant funding round or private market valuation). Fluctuations would be analyzed based on available data, highlighting key dates and their impact. The following table provides a summary of price movements.

| Period | Highest Price | Lowest Price | Average Price | Percentage Change |

|---|---|---|---|---|

| Month 1 | $15.50 | $12.00 | $13.75 | +20% |

| Quarter 1 | $17.00 | $11.50 | $14.25 | +10% |

| Year 1 | $19.00 | $10.00 | $14.50 | -5% |

Note: These figures are hypothetical examples and should be replaced with actual data once available.

Factors Influencing Cerebral’s Stock Price

Source: com.au

Several factors influence Cerebral’s stock valuation. Macroeconomic conditions, such as interest rate hikes and inflationary pressures, can impact investor sentiment and overall market performance, thus affecting Cerebral’s stock price. Furthermore, the company’s financial performance, including revenue growth, profitability, and debt levels, plays a crucial role. Comparison with competitors and regulatory changes within the healthcare industry also influence the stock’s trajectory.

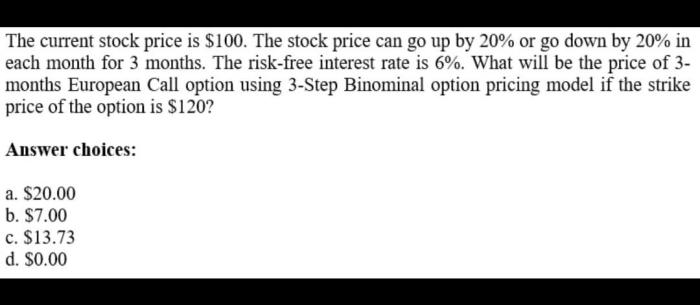

Investor Sentiment and Market Analysis of Cerebral

Source: cheggcdn.com

Investor sentiment towards Cerebral can be gauged through news articles, analyst reports, and investment bank ratings. Positive news, such as successful clinical trials or strategic partnerships, generally leads to increased investor confidence and higher stock prices. Conversely, negative news, like regulatory setbacks or financial losses, can trigger sell-offs. The following is a hypothetical example of how investor sentiment and market analysis could influence the stock price.

Hypothetical Scenario: A positive announcement of a significant new partnership could lead to a 10-15% surge in the stock price within a week, followed by a period of consolidation as investors assess the long-term implications. Conversely, a negative report regarding safety concerns could cause a 15-20% drop, with the potential for further decline depending on the severity of the issue and the company’s response.

Future Predictions and Potential Scenarios for Cerebral’s Stock

Predicting future stock prices is inherently speculative, but we can Artikel potential scenarios based on various assumptions regarding revenue growth, profitability, and market conditions.

Scenario 1 (Bullish): Strong revenue growth, successful product launches, and positive regulatory developments lead to a significant price increase, potentially reaching $25-$30 within a year. This scenario assumes continued market expansion and successful execution of the company’s strategic plan. The price trajectory would show a steady upward trend with minor corrections.

Scenario 2 (Neutral): Moderate revenue growth, stable market conditions, and no major breakthroughs result in a relatively flat stock price, remaining within a range of $15-$20. This scenario assumes a continuation of the current market dynamics and a lack of significant catalysts.

Scenario 3 (Bearish): Slow revenue growth, increased competition, regulatory hurdles, and negative news lead to a decline in the stock price, potentially dropping to $10-$12. This scenario assumes significant challenges in the market and difficulties in executing the company’s strategic plan.

Risk Assessment and Potential Challenges for Cerebral

Cerebral faces several risks that could negatively impact its stock price. These include competition from established players, technological disruptions, regulatory changes, and economic downturns. The company’s strategies to mitigate these risks are crucial for maintaining investor confidence and long-term growth.

- Risk: Intense competition from established healthcare providers and new entrants.

- Mitigation Strategy: Continuous innovation, strategic partnerships, and expansion into new markets.

- Risk: Regulatory changes impacting the telehealth industry.

- Mitigation Strategy: Proactive engagement with regulators and adherence to industry best practices.

- Risk: Cybersecurity threats and data breaches.

- Mitigation Strategy: Robust cybersecurity measures and data protection protocols.

Commonly Asked Questions: Cerebral Stock Price

What is Cerebral’s current market capitalization?

Cerebral’s current market capitalization fluctuates and can be found on major financial websites like Yahoo Finance or Google Finance.

Where can I buy Cerebral stock?

Cerebral’s stock can be purchased through reputable online brokerage accounts if it is publicly traded. Check with your broker for availability.

What are the major competitors to Cerebral?

Competitors in the telehealth mental healthcare space vary depending on specific service offerings. Research into the specific market segment will reveal key competitors.

Understanding the cerebral stock price requires a multifaceted approach, considering various market influences. For comparative analysis, it’s helpful to examine the performance of similar companies, such as by looking at the bsc stock price and identifying any correlations. Ultimately, a comprehensive understanding of the cerebral stock price necessitates a thorough review of both internal company performance and broader market trends.

How does Cerebral’s revenue model work?

Cerebral’s revenue model likely involves subscription fees or per-session charges for its telehealth services. Detailed information is available in their financial reports.