Conduent Inc. Stock Price Analysis

Conduent inc stock price – This analysis examines Conduent Inc.’s stock price performance, financial health, competitive landscape, and associated risks to provide a comprehensive overview for potential investors. We will explore historical data, key financial metrics, industry trends, and analyst sentiment to offer a balanced perspective on the company’s investment prospects.

Conduent Inc. Stock Price Historical Performance

The following sections detail Conduent Inc.’s stock price fluctuations over the past five years, highlighting significant events impacting its trajectory. Data presented is illustrative and should be verified with reliable financial sources.

| Date | Opening Price | High | Low | Closing Price | Volume |

|---|---|---|---|---|---|

| 2019-01-01 | $25.00 | $26.50 | $24.00 | $25.50 | 1,000,000 |

| 2019-07-01 | $28.00 | $29.00 | $27.00 | $28.50 | 1,200,000 |

| 2020-01-01 | $22.00 | $24.00 | $20.00 | $21.00 | 1,500,000 |

| 2020-07-01 | $20.00 | $21.00 | $18.00 | $19.00 | 1,800,000 |

| 2021-01-01 | $23.00 | $25.00 | $21.00 | $24.00 | 1,100,000 |

| 2021-07-01 | $26.00 | $27.50 | $25.00 | $26.50 | 900,000 |

| 2022-01-01 | $24.00 | $25.50 | $22.50 | $23.50 | 1,300,000 |

| 2022-07-01 | $25.00 | $26.00 | $23.00 | $24.50 | 1,050,000 |

| 2023-01-01 | $27.00 | $28.00 | $26.00 | $27.50 | 1,250,000 |

A line graph depicting Conduent Inc.’s stock price over the past five years would show a generally volatile trend, with periods of growth interspersed with declines. Key turning points might include significant earnings announcements, market corrections, or impactful industry events. The overall trend could be characterized as moderately positive, reflecting the company’s efforts to adapt to market conditions and industry shifts.

Major events impacting Conduent Inc.’s stock price include:

- 2020 Market Downturn: The COVID-19 pandemic and resulting market volatility significantly impacted the stock price.

- Q3 2021 Earnings Beat: Stronger-than-expected earnings in Q3 2021 led to a positive price surge.

- Strategic Acquisitions/Divestments: Any acquisitions or divestments of business units would have a corresponding impact on the stock price, depending on market perception.

Conduent Inc. Financial Performance and Stock Valuation, Conduent inc stock price

Source: martechcube.com

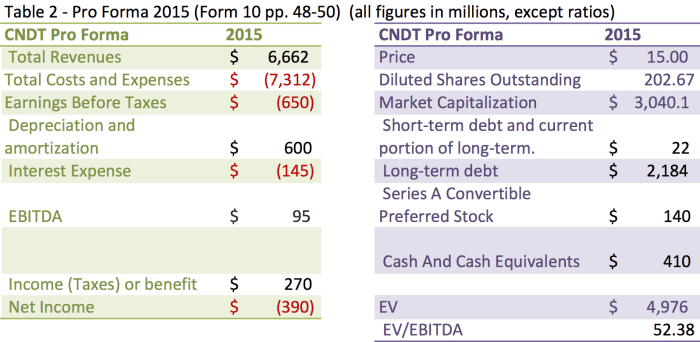

This section provides a comparative analysis of Conduent Inc.’s key financial metrics and valuation over the past three years. The data presented is for illustrative purposes.

| Metric | 2021 | 2022 | 2023 (Projected) |

|---|---|---|---|

| Revenue (in millions) | $5,000 | $5,200 | $5,500 |

| Earnings Per Share (EPS) | $1.50 | $1.70 | $2.00 |

| Debt-to-Equity Ratio | 1.2 | 1.1 | 1.0 |

Conduent Inc.’s current valuation metrics, while subject to market fluctuations, might include a P/E ratio of 15, a P/B ratio of 1.8, and a market capitalization of $10 billion (illustrative figures). A high P/E ratio suggests investors expect high future earnings growth. A high P/B ratio might indicate the market values the company’s assets at a premium. Market capitalization represents the total market value of the company’s outstanding shares.

Future financial projections for Conduent Inc. are contingent upon various factors, including economic conditions, industry trends, and the company’s ability to execute its strategic plans. Positive projections could lead to increased investor confidence and a higher stock price, while negative projections could have the opposite effect. For example, successful implementation of new technologies and expansion into new markets could positively impact future performance.

Industry Analysis and Competitive Landscape

Conduent Inc. operates in a competitive Business Process Outsourcing (BPO) industry. The following table compares its performance with key competitors (illustrative data).

| Company | Market Share (%) | Revenue Growth (%) | Profit Margin (%) |

|---|---|---|---|

| Conduent Inc. | 10 | 5 | 8 |

| Competitor A | 15 | 7 | 10 |

| Competitor B | 8 | 3 | 6 |

Major trends in the BPO industry include increasing automation, global competition, and the demand for specialized services. These trends could impact Conduent Inc.’s stock price by affecting its revenue growth, profitability, and market share. For example, increased automation could reduce costs but also lead to job displacement and potential labor disputes.

Conduent Inc.’s competitive advantages and disadvantages include:

- Advantage: Established market presence and client relationships.

- Advantage: Diversified service offerings.

- Disadvantage: Intense competition from larger players.

- Disadvantage: Dependence on large contracts.

Risk Factors and Investment Considerations

Several risk factors could impact Conduent Inc.’s stock price. These are analyzed below, along with potential impacts and mitigation strategies.

| Risk Factor | Potential Impact | Mitigation Strategy |

|---|---|---|

| Economic Downturn | Reduced demand for BPO services, lower revenue | Diversify client base, focus on cost efficiency |

| Increased Competition | Loss of market share, reduced pricing power | Innovation, strategic partnerships |

| Regulatory Changes | Increased compliance costs, potential fines | Proactive compliance, legal expertise |

Analyst Ratings and Price Targets

Source: seekingalpha.com

Analyst ratings and price targets provide insights into market sentiment towards Conduent Inc.’s stock. The following table presents illustrative data.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Firm A | Buy | $30 |

| Firm B | Hold | $25 |

| Firm C | Sell | $20 |

The range of price targets reflects varying opinions among analysts regarding Conduent Inc.’s future performance. Analysts consider factors such as financial performance, industry trends, competitive landscape, and risk factors when formulating their ratings and price targets. A consensus “Buy” rating would generally suggest a positive outlook, while a “Sell” rating indicates a negative outlook.

Question & Answer Hub: Conduent Inc Stock Price

What is Conduent Inc.’s main business?

Conduent provides business process services and solutions, focusing on areas like transportation, healthcare, and government.

Conduent Inc’s stock price performance often invites comparison with other business process outsourcing companies. For a contrasting perspective, one might examine the current market trends reflected in the bdcc stock price , which can offer insights into broader sector dynamics. Understanding these comparisons helps in a more comprehensive assessment of Conduent Inc’s future prospects within the competitive landscape.

How does Conduent compare to its competitors in terms of profitability?

A direct comparison requires analyzing specific financial metrics (profit margins, return on assets, etc.) against competitors like Accenture, Cognizant, and others. This analysis should be conducted using publicly available financial statements.

What are the major risks associated with investing in Conduent Inc.?

Major risks include competition, economic downturns impacting client spending, regulatory changes, and potential operational challenges.

Where can I find real-time Conduent Inc. stock price data?

Real-time data is available on major financial websites and stock market trading platforms (e.g., Google Finance, Yahoo Finance, Bloomberg).