Corbus Pharmaceuticals Stock Price Analysis

Corbus stock price – Corbus Pharmaceuticals Holdings, Inc. (CRBP) operates in the biopharmaceutical sector, focusing on developing novel therapies for debilitating rare and autoimmune diseases. This analysis delves into various aspects influencing CRBP’s stock price, providing insights for potential investors.

Corbus Pharmaceuticals Overview

Corbus Pharmaceuticals is a clinical-stage biopharmaceutical company primarily focused on developing and commercializing innovative therapies for chronic inflammatory and autoimmune diseases. Their business model centers around advancing their pipeline of drug candidates through various stages of clinical development, seeking regulatory approvals, and ultimately bringing successful products to market. Their primary focus is on addressing unmet medical needs in areas where existing treatments have limited efficacy or significant side effects.

Corbus’s Drug Pipeline and Development Stages

Source: seekingalpha.com

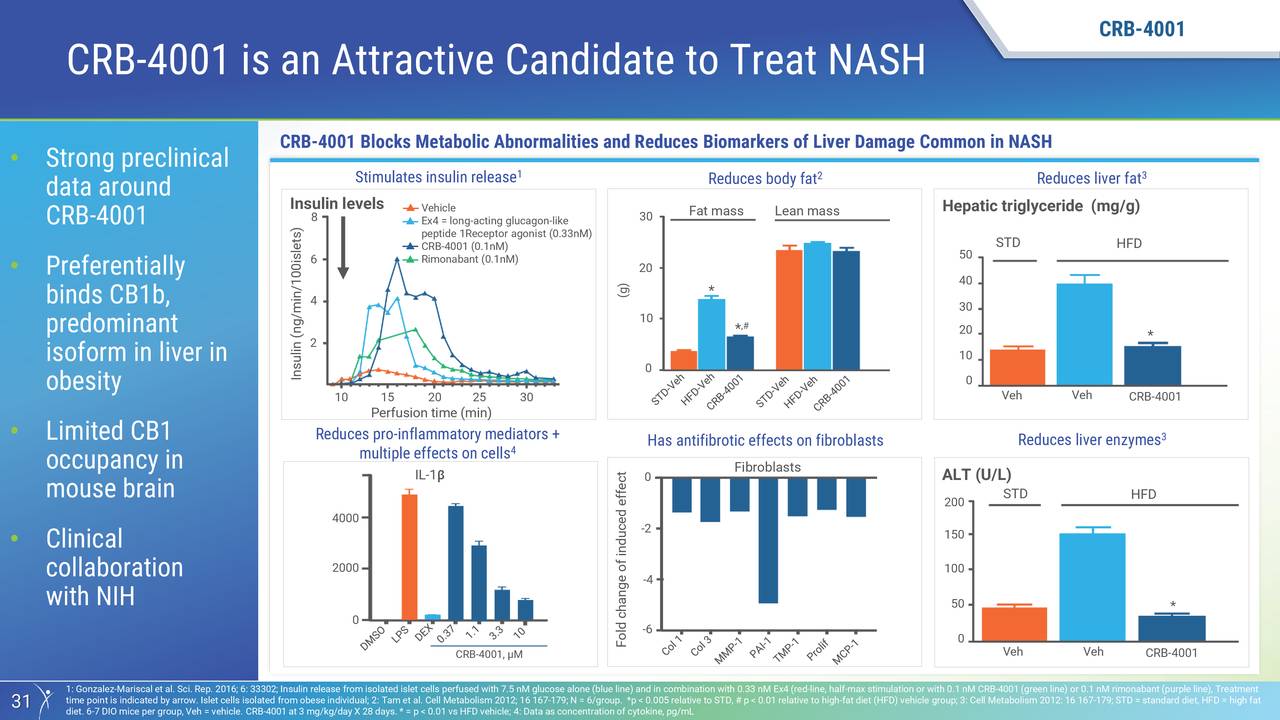

Corbus’s pipeline includes several drug candidates at different stages of development. Information regarding specific candidates, their indications, and development phases requires referencing the most recent company disclosures and SEC filings. Historically, the company has focused on lenabasum, a selective resolution agonist, for various autoimmune diseases. The progress of these candidates, including any successes or setbacks in clinical trials, significantly impacts the company’s stock price.

Historical Stock Performance and Significant Events, Corbus stock price

Corbus’s stock performance has been volatile, reflecting the inherent risks and uncertainties associated with clinical-stage biopharmaceutical companies. Significant events, such as positive or negative clinical trial results, regulatory decisions (approvals or rejections), and major partnerships or collaborations, have historically driven substantial price fluctuations. A detailed historical analysis would require examining CRBP’s stock chart over time, correlating price movements with specific events impacting the company.

Factors Influencing Corbus Stock Price

Several key factors influence Corbus’s stock price. These include the progress and outcomes of clinical trials for its drug candidates, regulatory approvals or rejections, market sentiment towards the company and its therapeutic area, and broader macroeconomic conditions affecting the pharmaceutical industry. Furthermore, competitive landscape analysis and comparison to other companies in similar therapeutic areas plays a crucial role.

Corbus Stock Performance Compared to Competitors

Comparing Corbus’s performance to its competitors requires analyzing key financial metrics. The following table provides a hypothetical comparison; actual data should be obtained from reliable financial sources.

| Company | Market Cap (USD Million) | P/E Ratio | Annual Revenue (USD Million) |

|---|---|---|---|

| Corbus Pharmaceuticals (CRBP) | 100 (Hypothetical) | N/A (Hypothetical) | 5 (Hypothetical) |

| Competitor A | 500 (Hypothetical) | 20 (Hypothetical) | 100 (Hypothetical) |

| Competitor B | 250 (Hypothetical) | 15 (Hypothetical) | 50 (Hypothetical) |

| Competitor C | 750 (Hypothetical) | 25 (Hypothetical) | 150 (Hypothetical) |

Financial Performance and Valuation

Corbus’s recent financial reports should be reviewed for details on revenue, expenses, profitability, and debt levels. These figures provide insights into the company’s financial health and sustainability. Analyzing these reports, along with projections based on clinical trial outcomes, allows for a more comprehensive valuation assessment. Remember that financial data is dynamic and changes frequently.

Hypothetical Clinical Trial Outcome Impact on Valuation

Source: seekingalpha.com

Let’s consider two scenarios: A successful Phase 3 trial for a lead drug candidate could significantly boost Corbus’s valuation, potentially attracting investment and increasing the stock price. Conversely, a failed trial would likely result in a substantial drop in valuation, reflecting the reduced probability of future revenue generation. This illustrates the high degree of risk associated with investing in clinical-stage biotech companies.

Investor Sentiment and Analyst Ratings

Investor sentiment towards Corbus is reflected in the stock price, trading volume, and analyst ratings. Analysts’ buy/sell recommendations and price targets provide insights into the market’s perception of the company’s prospects. Reviewing recent news articles and press releases helps gauge current investor sentiment and identify any significant shifts in perception.

Risk Assessment

Investing in Corbus Pharmaceuticals involves significant risks. These include the inherent uncertainties associated with clinical trials (failure to meet endpoints, unexpected side effects), competition from other companies developing similar therapies, regulatory hurdles (delays or rejection of drug approvals), and overall market volatility impacting the biotech sector.

Corbus Pharmaceuticals’ stock price has seen considerable fluctuation recently, largely influenced by the progress of its clinical trials. Investors often compare its performance to similar biotech companies, and a key benchmark for some is the current performance of blnd stock price , which provides a useful point of reference within the broader biopharmaceutical sector. Ultimately, though, Corbus’s trajectory remains dependent on its own research and development milestones.

- Clinical trial failure

- Competitive pressures

- Regulatory setbacks

- Market volatility

Investors can mitigate some risks through diversification, thorough due diligence, and a long-term investment horizon. Understanding the inherent risks and the company’s dependence on clinical trial success is crucial for informed investment decisions.

Mitigation Strategies

- Diversify investment portfolio

- Thorough due diligence and research

- Long-term investment strategy

- Consider risk tolerance

Future Outlook and Potential

Source: seekingalpha.com

Corbus’s future prospects depend heavily on the success of its ongoing and future clinical trials. Positive results could lead to regulatory approvals, market entry, and revenue generation, significantly boosting the stock price. Conversely, setbacks could lead to a decline in the stock price. The company’s ability to secure additional funding and partnerships will also influence its future trajectory.

Hypothetical Stock Price Scenarios

Imagine a stock price chart showing three possible scenarios: a best-case scenario (successful drug launch and strong market adoption), a base-case scenario (moderate success with some delays), and a worst-case scenario (clinical trial failure and significant setbacks). The best-case scenario would show a sharp upward trend, the base-case a more gradual increase with potential fluctuations, and the worst-case a significant decline.

This visual representation (description only) illustrates the range of potential outcomes and the inherent volatility of the stock.

FAQ: Corbus Stock Price

What is Corbus Pharmaceuticals’ primary focus?

Corbus Pharmaceuticals focuses on developing novel therapies for inflammatory and autoimmune diseases.

How volatile is Corbus stock?

Corbus stock, like many biotech stocks, is considered relatively volatile due to its dependence on clinical trial outcomes and regulatory approvals.

Where can I find real-time Corbus stock quotes?

Real-time Corbus stock quotes are available through major financial websites and brokerage platforms.

What are the major risks associated with investing in Corbus?

Major risks include clinical trial failures, regulatory setbacks, and competition from other pharmaceutical companies.