McDonald’s Stock Price: A Comprehensive Analysis

Current stock price for mcdonalds – McDonald’s Corporation (MCD), a global fast-food giant, offers a compelling case study in stock market dynamics. Understanding its stock price requires analyzing various interconnected factors, from macroeconomic trends to company-specific news and investor sentiment. This analysis delves into the key drivers of McDonald’s stock price, providing insights into its historical volatility, predictive methods, and the crucial role of financial performance.

Reliable Sources for McDonald’s Stock Price Data

Accurate and timely stock price data is crucial for any analysis. Several reputable sources provide real-time and historical data for McDonald’s stock (MCD).

- Major Financial Data Providers: These include Bloomberg Terminal, Refinitiv Eikon, and FactSet. These platforms offer comprehensive data sets with advanced analytical tools.

- Brokerage Platforms: Most online brokerage accounts (e.g., Fidelity, Schwab, TD Ameritrade) provide real-time quotes and historical data for publicly traded stocks like MCD.

- Financial News Websites: Websites such as Yahoo Finance, Google Finance, and MarketWatch offer free access to real-time and historical stock prices, although the depth of historical data may be limited compared to professional platforms.

Data can be collected automatically using APIs (Application Programming Interfaces) offered by many data providers. For example, Yahoo Finance provides a readily accessible API. Data updates should ideally occur at least once daily, or even more frequently (e.g., every 15 minutes) for real-time tracking. However, over-frequent updates might lead to unnecessary data storage and processing.

Sample Week of McDonald’s Stock Price Data

The following table displays hypothetical stock price data for a sample week. Note that these figures are for illustrative purposes only and do not represent actual market data.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| 2024-10-28 | 275.00 | 276.50 | 274.00 | 275.75 | 1,500,000 |

| 2024-10-29 | 276.00 | 278.25 | 275.50 | 277.50 | 1,800,000 |

| 2024-10-30 | 277.00 | 279.00 | 276.25 | 278.50 | 1,600,000 |

| 2024-10-31 | 278.00 | 279.50 | 277.00 | 278.75 | 1,300,000 |

| 2024-11-01 | 279.00 | 281.00 | 278.00 | 280.00 | 2,000,000 |

| 2024-11-04 | 280.50 | 282.00 | 279.50 | 281.25 | 1,700,000 |

| 2024-11-05 | 281.00 | 283.00 | 280.00 | 282.50 | 1,900,000 |

Macroeconomic Factors and McDonald’s Stock Price, Current stock price for mcdonalds

Macroeconomic conditions significantly influence McDonald’s stock performance. Inflation, for instance, affects consumer spending and input costs. Higher inflation can reduce consumer discretionary spending, impacting McDonald’s sales. Conversely, interest rate hikes increase borrowing costs for the company and can decrease investor appetite for stocks, potentially leading to lower valuations.

Company-Specific News and Stock Price Fluctuations

Company-specific events, such as menu innovations (e.g., the introduction of new menu items or limited-time offers), successful marketing campaigns, or significant operational changes (e.g., restaurant renovations or technology upgrades), can cause substantial short-term stock price volatility. Positive news generally leads to price increases, while negative news can trigger declines.

Competitor Actions and Industry Trends

McDonald’s operates in a competitive fast-food landscape. Actions by competitors (e.g., new product launches, pricing strategies, or marketing initiatives) can directly impact McDonald’s market share and stock price. Broader industry trends, such as shifts in consumer preferences (e.g., towards healthier options or more sustainable practices), also play a significant role in shaping the company’s performance and its stock valuation.

Historical Volatility and Stock Price Prediction

McDonald’s stock price has exhibited varying degrees of volatility over time. Periods of economic uncertainty or significant company-specific events tend to increase volatility. Predicting future stock price movements is inherently challenging. However, several methods are employed, including technical analysis (chart patterns, indicators), fundamental analysis (financial statements, valuation ratios), and quantitative models (statistical forecasting).

For example, a significant news event like a major food safety incident could trigger a sharp, immediate drop in the stock price. Conversely, the announcement of a highly successful new product line could result in a rapid price surge.

Investor Sentiment and Stock Price

Source: businessinsider.com

Investor sentiment, encompassing overall optimism or pessimism towards McDonald’s, profoundly impacts its stock price. Positive sentiment drives demand for the stock, pushing prices higher, while negative sentiment can lead to selling pressure and price declines.

Keeping an eye on the current stock price for McDonald’s is important for many investors. Understanding market fluctuations requires looking at a broader context, and comparing it to other companies. For instance, you might also want to check the chemours stock price today to gain a more comprehensive view of the market’s performance. Ultimately, though, the focus remains on the McDonald’s stock price and its trajectory.

- News Articles and Social Media: Positive media coverage and social media buzz generally enhance investor sentiment, whereas negative news or social media criticism can have the opposite effect.

- Analyst Ratings: Stock analyst ratings and price target changes influence investor perception and can significantly impact the stock price.

McDonald’s Financial Performance and Stock Price

Source: seekingalpha.com

McDonald’s financial reports (quarterly and annual earnings releases) are closely scrutinized by investors. Strong financial performance (e.g., increasing revenue, profits, and positive cash flow) typically leads to higher stock prices, while disappointing results often cause price declines.

- Earnings Per Share (EPS): Measures the company’s profitability per share of outstanding stock.

- Revenue Growth: Indicates the rate at which the company’s sales are increasing.

- Debt-to-Equity Ratio: Shows the proportion of company financing from debt versus equity.

- Return on Equity (ROE): Measures the company’s profitability relative to shareholder equity.

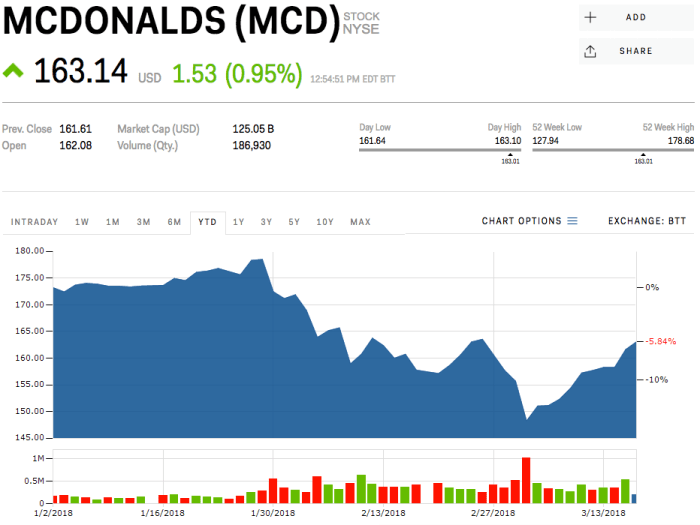

Visual Representation of Stock Price Trends

Source: investorplace.com

A typical McDonald’s stock price chart might show periods of upward trends (bull markets), downward trends (bear markets), and periods of consolidation. Support levels represent price points where buying pressure tends to outweigh selling pressure, preventing further price declines. Resistance levels are the opposite, indicating price points where selling pressure tends to dominate, hindering further price increases.

A hypothetical chart might show a long-term upward trend with several short-term fluctuations. There could be significant peaks following positive news announcements and troughs following negative news or macroeconomic downturns. Head and shoulders patterns, for example, could signal a potential trend reversal.

FAQs: Current Stock Price For Mcdonalds

What are the major risks associated with investing in McDonald’s stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. For McDonald’s, risks might include changing consumer preferences, competition from other fast-food chains, and fluctuations in commodity prices.

Where can I find real-time McDonald’s stock price updates?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes for MCD (McDonald’s Corporation).

How often does McDonald’s release its financial reports?

McDonald’s typically releases quarterly and annual financial reports, following standard reporting periods for publicly traded companies. These reports are available on their investor relations website.

What is the typical trading volume for McDonald’s stock?

McDonald’s stock generally experiences high trading volume, reflecting its popularity and market capitalization. You can find daily trading volume data on most financial websites.