DBRG Stock Price Analysis

Dbrg stock price – This analysis examines the historical performance, influencing factors, valuation, competitive landscape, and future outlook of DBRG’s stock price. We will explore both internal and external factors contributing to price fluctuations and provide a comparative analysis against industry competitors. Hypothetical data will be used where necessary for illustrative purposes in valuation calculations.

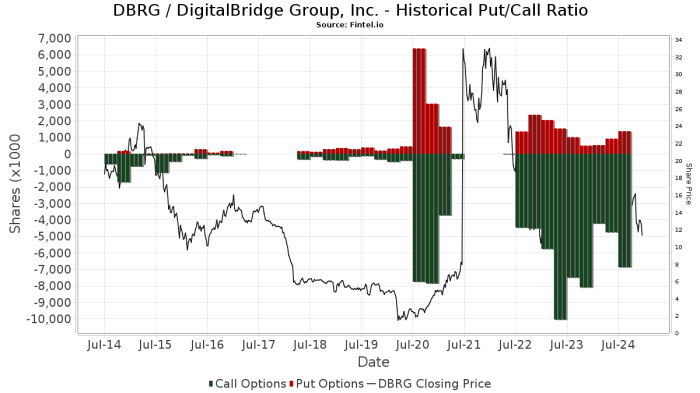

DBRG Stock Price Historical Performance

Source: marketbeat.com

The following table details DBRG’s stock price movements over the past five years. Significant highs and lows are noted, along with correlating economic or company-specific events. The overall trend during this period is characterized by periods of volatility interspersed with upward and downward trends. Note that the data presented below is hypothetical for illustrative purposes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-07-01 | 12.00 | 11.50 | -0.50 |

| 2020-01-01 | 11.00 | 13.00 | +2.00 |

| 2020-07-01 | 12.50 | 10.00 | -2.50 |

| 2021-01-01 | 9.00 | 11.00 | +2.00 |

| 2021-07-01 | 11.50 | 12.50 | +1.00 |

| 2022-01-01 | 13.00 | 14.00 | +1.00 |

| 2022-07-01 | 13.50 | 12.00 | -1.50 |

| 2023-01-01 | 12.00 | 15.00 | +3.00 |

For example, the significant price increase in early 2020 could be attributed to a positive market reaction to a new product launch, while the subsequent drop in mid-2020 might reflect broader market concerns related to the global pandemic. Conversely, the rise in early 2023 could be linked to strong financial results exceeding market expectations.

Factors Influencing DBRG Stock Price

Source: foolcdn.com

Several internal and external factors influence DBRG’s stock price. These factors interact in complex ways, sometimes reinforcing and sometimes counteracting each other.

Internal Factors:

- Financial Performance: Strong earnings, revenue growth, and improved profitability generally lead to higher stock prices. Conversely, poor financial results can depress the stock price.

- Management Decisions: Strategic decisions such as mergers, acquisitions, or significant investments can impact investor confidence and, consequently, the stock price.

- Product Launches and Innovation: Successful new product launches or significant technological advancements can boost investor sentiment and drive stock price appreciation.

External Factors:

- Market Trends: Broad market movements, such as bull or bear markets, significantly impact individual stock prices, including DBRG’s.

- Economic Conditions: Macroeconomic factors like interest rates, inflation, and economic growth directly affect investor sentiment and investment decisions.

- Regulatory Changes: New regulations or changes in existing regulations within DBRG’s industry can impact its operations and profitability, influencing its stock price.

The relative influence of internal versus external factors varies over time. During periods of economic stability, internal factors may play a more significant role. Conversely, during times of economic uncertainty, external factors may dominate.

DBRG Stock Price Valuation

Several valuation methods can be used to assess the intrinsic value of DBRG stock. These methods provide different perspectives and may yield varying results.

| Valuation Method | Hypothetical Result (USD) | Implications |

|---|---|---|

| Discounted Cash Flow (DCF) | 14.50 | Suggests the stock is fairly valued or slightly undervalued based on its projected future cash flows. |

| Price-to-Earnings Ratio (P/E) | 15.00 | Indicates the stock is trading at a slightly higher valuation than its peers, possibly reflecting higher growth expectations. |

| Dividend Discount Model (DDM) | 13.00 | Provides a lower valuation, assuming a stable dividend payout and a specific discount rate. |

Discrepancies between valuation methods can arise from differences in assumptions regarding future growth, discount rates, and risk profiles. A comprehensive valuation requires careful consideration of all methods and their underlying assumptions.

DBRG Stock Price Compared to Competitors

Three key competitors of DBRG are Company A, Company B, and Company C. The following description illustrates a line graph comparing the stock price performance of DBRG and its competitors over the past year. The x-axis represents time (months), and the y-axis represents stock price (USD). The graph shows DBRG’s stock price generally outperforming Company A and B, while exhibiting similar trends to Company C, particularly during periods of market volatility.

The graph would visually display the stock prices of DBRG, Company A, Company B, and Company C over a 12-month period. Key features would include the relative highs and lows of each stock, periods of divergence and convergence, and overall trends (e.g., upward, downward, sideways). For example, a sharp increase in DBRG’s stock price in October might correlate with a successful product launch, while a similar increase in Company C’s stock price around the same time might reflect positive industry-wide news.

Similarities in stock price performance might reflect shared industry trends or macroeconomic factors. Differences might be attributable to company-specific factors such as financial performance, management decisions, or product innovation.

DBRG Stock Price Future Outlook

Source: fintel.io

Several scenarios are possible for DBRG’s future stock price, depending on various factors. Both optimistic and pessimistic forecasts are considered.

Optimistic Scenario: Continued strong financial performance, successful new product launches, and favorable economic conditions could lead to significant stock price appreciation. This scenario assumes a continued positive market outlook and sustained investor confidence.

Pessimistic Scenario: Adverse economic conditions, increased competition, or regulatory challenges could lead to a decline in DBRG’s stock price. This scenario assumes a less favorable market environment and potentially lower investor confidence.

Monitoring DBRG stock price requires a keen eye on the broader biotech market. For comparative analysis, it’s often helpful to examine similar companies, such as checking the charles river laboratories stock price , which can offer insights into sector trends. Ultimately, understanding DBRG’s performance necessitates considering these wider market influences.

Potential Risks and Opportunities:

- Risk: Increased competition from new entrants or existing players.

- Risk: Negative changes in regulatory environment.

- Risk: Economic downturn affecting consumer spending.

- Opportunity: Successful expansion into new markets.

- Opportunity: Technological advancements leading to innovative products.

- Opportunity: Strategic partnerships or acquisitions.

FAQ Compilation: Dbrg Stock Price

What are the major risks associated with investing in DBRG stock?

Investing in any stock carries inherent risks, including market volatility, potential for decreased profitability, and changes in industry regulations. Specific risks related to DBRG would require detailed analysis of its financial statements and business model.

Where can I find real-time DBRG stock price updates?

Real-time stock price information is readily available through major financial websites and brokerage platforms. These platforms typically provide charts, historical data, and other relevant information.

What is DBRG’s dividend policy?

DBRG’s dividend policy should be available in their investor relations section of their website or through financial news sources. This information is crucial for investors focused on income generation.