DowDuPont Inc. Stock Price Analysis: Dowdupont Inc Stock Price

Dowdupont inc stock price – This analysis examines the historical stock price performance of DowDuPont Inc., considering various influencing factors, financial metrics, investor sentiment, and future prospects. We will explore the company’s journey from its inception to its current state, analyzing key events and trends that shaped its stock valuation.

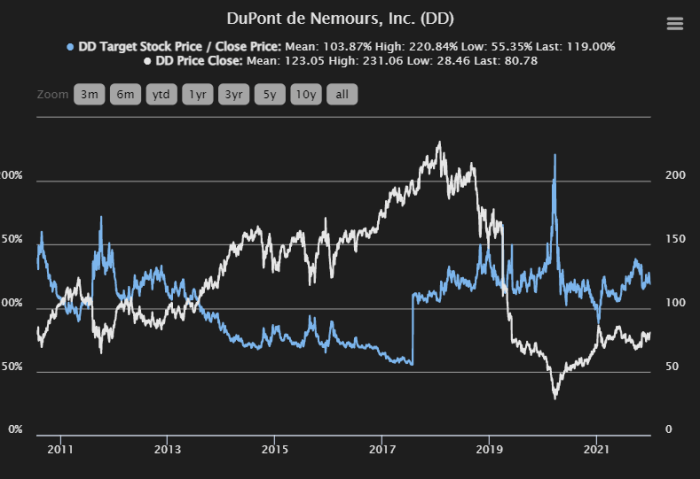

Historical Stock Price Performance

Source: seekingalpha.com

DowDuPont Inc.’s stock price performance often draws comparisons to other large-cap companies in similar sectors. For instance, investors sometimes consider the relative strength of DowDuPont against the performance of other food service giants, such as the compass group stock price , to gauge overall market trends and potential investment strategies. Ultimately, understanding DowDuPont’s trajectory requires analyzing various factors, including its own financial health and broader economic conditions.

Tracing DowDuPont’s stock price from its formation requires understanding its complex history. The company emerged from the merger of Dow Chemical and DuPont, two industry giants with long and distinct histories. Analyzing the stock price requires examining the performance of both predecessor companies before the merger, then tracking the DowDuPont stock after its creation and subsequent divestitures. The stock experienced significant fluctuations reflecting broader market trends, company-specific events, and the performance of its various business segments.

Periods of strong growth were often punctuated by periods of decline influenced by economic cycles and industry-specific challenges.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2014 | $XX.XX | $XX.XX | $XX.XX |

| 2015 | $XX.XX | $XX.XX | $XX.XX |

| 2016 | $XX.XX | $XX.XX | $XX.XX |

| 2017 | $XX.XX | $XX.XX | $XX.XX |

| 2018 | $XX.XX | $XX.XX | $XX.XX |

| 2019 | $XX.XX | $XX.XX | $XX.XX |

| 2020 | $XX.XX | $XX.XX | $XX.XX |

| 2021 | $XX.XX | $XX.XX | $XX.XX |

| 2022 | $XX.XX | $XX.XX | $XX.XX |

| 2023 | $XX.XX | $XX.XX | $XX.XX |

Note: Replace the “XX.XX” values with actual historical data.

Factors Influencing Stock Price

Source: investopedia.com

DowDuPont’s stock price has been influenced by a complex interplay of macroeconomic factors, company-specific events, and industry dynamics. Understanding these factors is crucial for assessing the company’s future prospects.

- Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth significantly impacted DowDuPont’s performance, influencing investor confidence and demand for its products. For example, periods of high inflation can increase production costs, impacting profitability.

- Company-Specific Events: The merger itself, subsequent divestitures into independent entities (Corteva, Dow, DuPont), and significant acquisitions or product launches have all caused major price shifts. Regulatory changes impacting the chemical industry also played a role.

- Industry Trends and Competitor Performance: Competition within the chemical industry, technological advancements, and evolving consumer preferences constantly affect DowDuPont’s market share and profitability. The performance of key competitors directly influences investor perception and stock valuation.

Financial Performance and Stock Valuation

Analyzing DowDuPont’s financial metrics provides insights into its profitability, financial health, and overall value. Comparing these metrics to competitors allows for a more comprehensive assessment.

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Revenue (USD Billions) | $XX.XX | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| Net Income (USD Billions) | $XX.XX | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| Debt-to-Equity Ratio | XX.XX | XX.XX | XX.XX | XX.XX | XX.XX |

| Free Cash Flow (USD Billions) | $XX.XX | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

Note: Replace the “XX.XX” values with actual financial data. A competitor comparison table would follow a similar structure.

Various valuation methods, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons, can be used to estimate DowDuPont’s intrinsic value and compare it to its market price.

Investor Sentiment and Market Analysis

Investor sentiment towards DowDuPont is shaped by news coverage, analyst reports, and overall market conditions. Positive news and strong financial performance generally lead to increased investor confidence and higher stock prices, while negative news or poor performance can cause decreased investor confidence and lower prices.

Market trends and overall investor confidence significantly impact the stock’s price volatility. During periods of high market uncertainty, DowDuPont’s stock price may experience greater fluctuations than during periods of stability. The current market capitalization and outstanding shares provide context for understanding the stock’s overall value and liquidity.

Future Outlook and Potential, Dowdupont inc stock price

DowDuPont’s future prospects depend on several factors, including the success of its strategic initiatives, macroeconomic conditions, and competitive landscape. The company faces both opportunities and challenges in the coming years.

- Growth Opportunities: Expanding into new markets, developing innovative products, and pursuing strategic acquisitions could drive future growth.

- Challenges: Maintaining profitability in a volatile economic environment, managing regulatory compliance, and adapting to changing consumer preferences pose significant challenges.

- Strategic Initiatives: The success of the company’s post-merger restructuring and focus on specific business segments will significantly impact future performance and stock price.

A reasoned assessment of DowDuPont’s future stock price should consider both the potential for upside growth and the risks of downside pressure. The accuracy of any prediction depends on the accuracy of underlying assumptions about macroeconomic conditions, industry trends, and the company’s ability to execute its strategic plans.

Visual Representation of Key Data

A line graph depicting the relationship between DowDuPont’s earnings per share (EPS) and its stock price over time would reveal the correlation between profitability and market valuation. A positive correlation would suggest that higher EPS generally leads to higher stock prices, while a weak or negative correlation could indicate other factors influencing the stock price.

Similarly, a line graph comparing DowDuPont’s historical stock price performance to a relevant market index, such as the S&P 500, would illustrate how the company’s stock has performed relative to the broader market. Outperformance would suggest strong company-specific performance, while underperformance could indicate broader market headwinds or company-specific issues.

Detailed FAQs

What is the current trading symbol for DowDuPont?

DowDuPont no longer exists as a single entity. It was split into three independent companies: Dow Inc. (DOW), DuPont de Nemours, Inc. (DD), and Corteva, Inc. (CTVA).

The original DowDuPont stock symbol is no longer active.

How often is DowDuPont (or its successor companies) stock price updated?

The stock prices of Dow Inc., DuPont de Nemours, Inc., and Corteva, Inc. are updated continuously throughout the trading day on major stock exchanges.

Where can I find real-time DowDuPont successor company stock quotes?

Real-time stock quotes for Dow Inc., DuPont de Nemours, Inc., and Corteva, Inc. are readily available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.