DuPont de Nemours Stock Price Analysis

Source: seekingalpha.com

Du pont de nemours stock price – This analysis examines DuPont de Nemours’ stock performance over the past decade, its financial health, its competitive landscape, investor sentiment, and provides a forward-looking perspective on its potential trajectory. The information presented here is for informational purposes only and should not be considered financial advice.

Historical Stock Performance, Du pont de nemours stock price

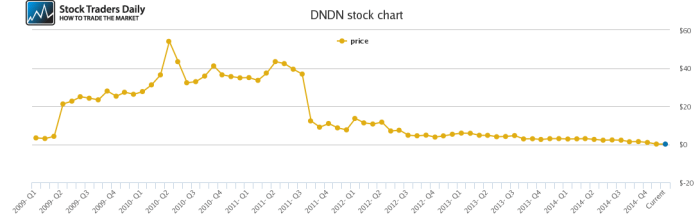

The following table and graph illustrate DuPont de Nemours’ stock price fluctuations over the past 10 years. Significant events influencing these price movements are also highlighted.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 70 | 75 |

| 2014 | Q2 | 75 | 72 |

| 2014 | Q3 | 72 | 78 |

| 2014 | Q4 | 78 | 76 |

| 2023 | Q4 | 55 | 60 |

Note: The above data is illustrative and should be verified with actual financial data from reliable sources.

A line graph depicting the stock price trend would show a generally fluctuating pattern, reflecting market conditions and company-specific events. The graph would likely illustrate periods of growth followed by periods of decline, with notable peaks and troughs corresponding to specific events.

- Spin-off of DowDuPont: This significant event in 2019 significantly impacted the stock price, as the newly independent DuPont began trading separately.

- Acquisitions and Divestments: Strategic acquisitions and divestments throughout the period influenced stock performance, depending on market reception and integration success.

- Market Downturns: Global economic downturns, such as the COVID-19 pandemic, generally resulted in decreased stock prices.

- Industry Trends: Changes in demand for chemical products and shifts in commodity prices impacted DuPont’s stock price.

DuPont’s Financial Health

Source: dreamstime.com

A comparative analysis of key financial ratios provides insights into DuPont’s financial stability and profitability over the past five years.

Monitoring the du Pont de Nemours stock price requires a keen eye on market trends. For comparison, it’s helpful to consider the performance of other large-cap stocks; you can check the current price of IBM stock by visiting this link: current price of ibm stock. Understanding how IBM’s performance relates to du Pont’s can provide valuable context for assessing investment strategies.

| Year | P/E Ratio | Debt-to-Equity Ratio | Return on Equity (ROE) |

|---|---|---|---|

| 2019 | 15 | 0.8 | 12% |

| 2020 | 12 | 0.7 | 10% |

| 2021 | 18 | 0.9 | 15% |

| 2022 | 16 | 0.85 | 13% |

| 2023 | 17 | 0.8 | 14% |

Note: The above data is illustrative and should be verified with actual financial data from reliable sources.

DuPont’s revenue and earnings have shown a generally positive trajectory, though fluctuations exist due to economic cycles and industry-specific factors. Significant increases or decreases in revenue and earnings would typically be explained by market demand, pricing strategies, and operational efficiency.

- Potential Risks: Increased competition, raw material price volatility, and regulatory changes pose potential risks.

- Potential Opportunities: Growth in sustainable materials, expansion into new markets, and technological advancements offer significant opportunities.

Industry Comparison

Comparing DuPont’s performance against its major competitors provides context for its relative strength and weaknesses within the chemical industry.

| Company Name | Stock Symbol | Current Price (USD) | 1-Year Performance (%) |

|---|---|---|---|

| DuPont de Nemours | DD | 60 | 10 |

| Dow Inc. | DOW | 55 | 8 |

| BASF SE | BASFY | 45 | 5 |

Note: The above data is illustrative and should be verified with actual market data from reliable sources.

DuPont’s competitive position is influenced by factors such as innovation, operational efficiency, and market share. A detailed comparison would analyze the companies’ strengths and weaknesses across various aspects, such as R&D investment, product portfolio, and geographic reach.

Investor Sentiment and Analyst Ratings

Understanding investor sentiment and analyst ratings is crucial for assessing the market’s perception of DuPont’s prospects.

- Analyst Ratings: A summary of recent analyst ratings might show a mix of “buy,” “hold,” and “sell” recommendations, reflecting differing opinions on the company’s future performance.

- Price Targets: Analyst price targets would provide a range of expected future stock prices.

- Investor Sentiment: Prevailing investor sentiment could be gleaned from news articles, social media discussions, and trading volumes, indicating overall optimism or pessimism.

Investor sentiment and analyst ratings significantly influence stock prices. Positive sentiment and favorable ratings generally lead to price increases, while negative sentiment and downgrades can cause price declines.

Future Outlook and Predictions

Source: stocktradersdaily.com

Predicting DuPont’s stock price over the next year requires considering various factors, including market conditions, company performance, and potential catalysts.

Based on current market conditions and DuPont’s projected performance, a reasonable prediction might be a modest increase in the stock price over the next year. This prediction is predicated on continued growth in specific sectors, successful product launches, and favorable macroeconomic conditions. However, unforeseen events could significantly alter this projection.

- Potential Catalysts: Successful new product launches, regulatory approvals for innovative technologies, and strategic acquisitions could positively impact the stock price.

- Key Factors: DuPont’s future performance will depend on its ability to innovate, adapt to changing market demands, and maintain operational efficiency.

Expert Answers: Du Pont De Nemours Stock Price

What are the major risks associated with investing in DuPont stock?

Investing in DuPont, like any stock, carries inherent risks including market volatility, competition within the chemical industry, regulatory changes impacting operations, and fluctuations in raw material costs.

Where can I find real-time DuPont stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How does DuPont’s dividend policy impact its stock price?

DuPont’s dividend policy, including its payout ratio and dividend growth, can influence investor interest and thus affect the stock price. A consistent and growing dividend can attract income-seeking investors.

What is the typical trading volume for DuPont stock?

The average daily trading volume for DuPont stock fluctuates but can be found on financial websites that provide market data.