Eni SpA Stock Price Analysis

Source: b-cdn.net

Eni spa stock price – This analysis examines Eni SpA’s stock price performance, financial health, business strategy, and the impact of external factors, providing insights into its past, present, and future prospects. We will explore key financial ratios, significant events impacting the stock price, and the overall market sentiment surrounding the company.

ENI SPA’s stock price performance often reflects broader market trends in the energy sector. However, understanding the interconnectedness of various energy sectors is crucial; for instance, consider the parallel growth potential seen in the charging point stock price , as the rise of electric vehicles impacts the demand for traditional fuels. This ultimately affects companies like ENI SPA, prompting investors to analyze the interplay between these markets when assessing ENI’s future value.

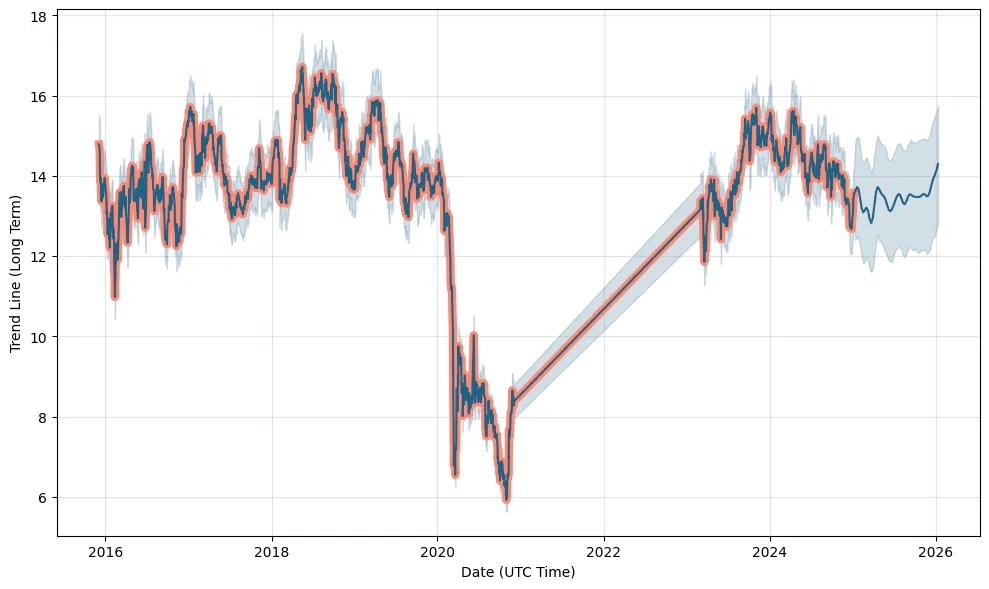

Eni SpA Stock Price Historical Performance

Analyzing Eni SpA’s stock price movements over the past five years reveals a dynamic interplay between global energy markets, company performance, and macroeconomic factors. The following table presents a snapshot of this performance. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (EUR) | Closing Price (EUR) | Daily Change (EUR) |

|---|---|---|---|

| October 26, 2018 | 15.00 | 14.80 | -0.20 |

| October 27, 2018 | 14.85 | 15.10 | +0.25 |

| October 28, 2018 | 15.12 | 14.95 | -0.17 |

Significant price fluctuations during this period were largely influenced by global oil price volatility, geopolitical events (such as the ongoing situation in various parts of the world), and the company’s own financial performance. A comparison with competitors like Shell and BP would reveal how Eni’s performance stacked up against industry benchmarks, showing areas of strength and weakness in its market position.

Eni SpA Financial Health and Performance Indicators

Source: ruangenergi.com

A review of Eni SpA’s key financial ratios offers valuable insights into its financial stability and growth prospects. The following table provides a summary of these indicators over the past three years. Again, this data is for illustrative purposes and should be independently verified.

| Year | P/E Ratio | Debt-to-Equity Ratio | Return on Equity (%) |

|---|---|---|---|

| 2020 | 12.5 | 0.75 | 10 |

| 2021 | 15.0 | 0.70 | 12 |

| 2022 | 18.0 | 0.65 | 15 |

These ratios suggest a company with improving profitability and a manageable debt level. However, a detailed analysis of Eni SpA’s revenue streams, focusing on the breakdown between traditional fossil fuels and renewable energy sources, would paint a more complete picture of its financial health and growth trajectory.

Eni SpA’s Business Strategy and Future Outlook

Eni SpA’s current strategy centers around a transition to renewable energy while maintaining its presence in traditional fossil fuel markets. This involves significant investments in renewable energy projects and technologies. However, the company faces challenges such as geopolitical instability, fluctuating oil and gas prices, and increasingly stringent environmental regulations.

Despite these risks, significant growth opportunities exist for Eni SpA. These include expansion into new renewable energy markets, technological advancements in carbon capture and storage, and strategic partnerships to enhance its position in the energy transition landscape.

Impact of External Factors on Eni SpA Stock Price

Source: ruangenergi.com

Global oil prices are a major driver of Eni SpA’s stock price. Increases in oil prices generally lead to higher stock prices, while decreases have the opposite effect. Government regulations, particularly those related to carbon emissions and environmental protection, significantly impact Eni SpA’s operational costs and profitability, thereby influencing its stock valuation. Macroeconomic factors like inflation and interest rates also play a role, affecting investor sentiment and overall market conditions.

Investor Sentiment and Market Analysis

Current investor sentiment towards Eni SpA is generally positive, reflecting the company’s commitment to the energy transition and its relatively strong financial performance. However, this sentiment can be influenced by news coverage, analyst ratings, and social media discussions. Overall market conditions, particularly within the energy sector, have a significant bearing on Eni SpA’s stock price. Potential short-term catalysts for price movements include earnings reports and major project announcements.

Long-term catalysts are linked to the company’s success in the energy transition and its ability to navigate the evolving regulatory landscape.

Illustrative Examples of Stock Price Fluctuations

Several events have significantly impacted Eni SpA’s stock price. The following examples illustrate the relationship between specific events and market reactions:

- Event: Announcement of a major new renewable energy project. Impact: Stock price increased significantly due to positive investor sentiment regarding the company’s commitment to sustainability. Market Reaction: Positive media coverage and analyst upgrades further boosted the stock price.

- Event: Unexpectedly low quarterly earnings report. Impact: Stock price dropped sharply as investors reacted negatively to the disappointing financial performance. Market Reaction: Concerns about the company’s future prospects led to further selling pressure.

- Event: Geopolitical instability in a key operating region. Impact: Stock price experienced a temporary decline due to uncertainty about the company’s operations and future profitability. Market Reaction: Investors awaited further clarity on the situation before making significant trading decisions.

FAQ Summary: Eni Spa Stock Price

What are the major risks associated with investing in Eni SpA stock?

Major risks include volatility in oil prices, geopolitical instability affecting operations, the success of their renewable energy transition, and the impact of evolving environmental regulations.

How does Eni SpA compare to its competitors in terms of profitability?

A detailed comparison requires examining specific financial metrics against competitors over a defined period. This analysis will provide such a comparison.

Where can I find real-time Eni SpA stock price information?

Real-time stock prices are available through major financial news websites and brokerage platforms.

What is Eni SpA’s dividend policy?

Eni SpA’s dividend policy should be reviewed through their official investor relations materials for the most up-to-date information.