FuboTV: A Deep Dive into its Business Model, Market Position, and Stock Price Prediction

Source: googleusercontent.com

Fubo stock price prediction – FuboTV, a sports-focused live TV streaming service, has garnered significant attention in the rapidly evolving streaming landscape. This analysis delves into FuboTV’s business model, market dynamics, and key factors influencing its stock price, providing insights into potential future performance.

FuboTV’s Business Model and Financial Performance

Source: seekingalpha.com

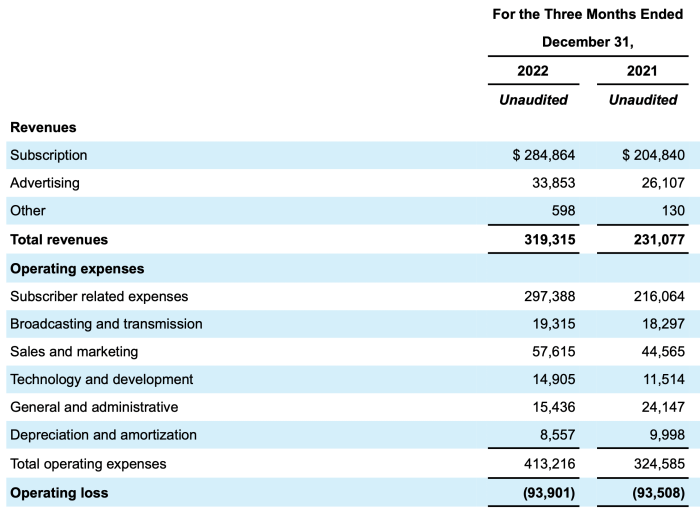

FuboTV’s core business model centers on providing a subscription-based streaming service offering a curated selection of live sports channels, alongside other entertainment options. Revenue streams primarily come from subscription fees, with additional income generated through advertising and potentially future avenues like interactive gaming and e-commerce integration. The target market consists of cord-cutters and cord-nevers, particularly those with a strong interest in live sports programming.

Recent financial performance has shown a mix of growth and challenges. While subscriber numbers have experienced periods of expansion, profitability remains elusive, highlighting the competitive nature of the streaming market and the company’s need for sustained growth to achieve financial stability.

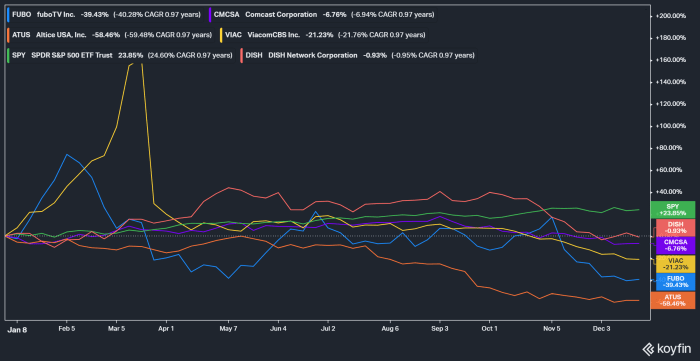

Competitive Landscape and Market Analysis

The live TV streaming market is experiencing robust growth, driven by increasing consumer demand for flexible and cost-effective entertainment options. However, the market is fiercely competitive, with established players and new entrants vying for market share. Key competitors include YouTube TV, Hulu + Live TV, and Sling TV, each with its strengths and weaknesses. Technological advancements, such as improved streaming technology and the rise of 5G, present both opportunities and challenges.

Regulatory changes and evolving consumer preferences, particularly regarding content consumption habits, also significantly influence the competitive landscape.

| Company | Revenue (USD Millions) | Subscribers (Millions) | Churn Rate (%) |

|---|---|---|---|

| FuboTV | [Insert FuboTV Data] | [Insert FuboTV Data] | [Insert FuboTV Data] |

| YouTube TV | [Insert YouTube TV Data] | [Insert YouTube TV Data] | [Insert YouTube TV Data] |

| Hulu + Live TV | [Insert Hulu + Live TV Data] | [Insert Hulu + Live TV Data] | [Insert Hulu + Live TV Data] |

| Sling TV | [Insert Sling TV Data] | [Insert Sling TV Data] | [Insert Sling TV Data] |

Factors Influencing Fubo Stock Price

Macroeconomic factors, such as interest rate fluctuations, inflation levels, and overall economic growth, significantly impact investor sentiment and market trends, consequently affecting FuboTV’s stock price. Positive economic indicators generally boost investor confidence, while negative indicators can lead to decreased investment and lower stock prices. News and events, including new partnerships, product launches, and regulatory announcements, can also trigger significant price fluctuations.

For instance, a successful new partnership with a major sports league could lead to a surge in stock price, while negative regulatory changes might result in a decline.

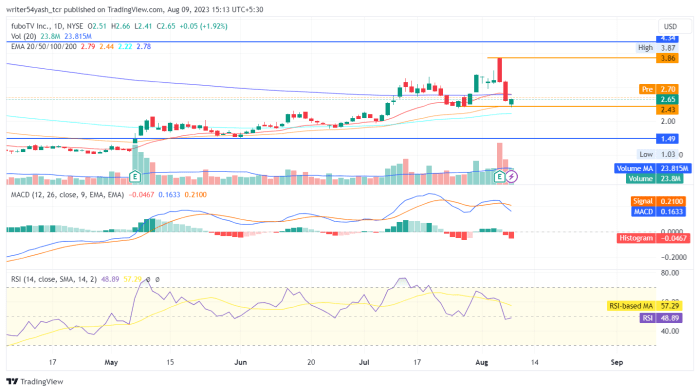

Technical Analysis of Fubo Stock

A technical analysis of FuboTV’s stock would involve examining chart patterns, support and resistance levels, and various trading indicators. For example, a hypothetical head and shoulders pattern, characterized by three peaks with the middle peak being the highest, could suggest a potential bearish reversal. Trading strategies could range from short-term swing trading based on identified chart patterns to long-term investing based on fundamental analysis.

Moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are examples of technical indicators used to predict potential price movements. A rising RSI above 70 could suggest an overbought condition, potentially indicating a price correction.

Fundamental Analysis of Fubo Stock, Fubo stock price prediction

Source: seekingalpha.com

A fundamental analysis of FuboTV would assess its financial health, competitive position, and growth prospects. This would involve examining key financial statements, evaluating the effectiveness of its business model, and comparing its performance against competitors. The analysis would also consider the company’s long-term growth potential and its ability to navigate the challenges in the streaming market.

- Strong growth potential in the live TV streaming market.

- First-mover advantage in the sports-focused streaming niche.

- Challenges in achieving profitability and managing subscriber churn.

- High level of competition from established players.

Valuation metrics, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, would be used to compare FuboTV’s valuation to its peers, offering insights into its relative attractiveness as an investment.

Risk Assessment and Potential Scenarios

Investing in FuboTV stock carries several inherent risks. Intense competition, potential financial losses due to high operating costs and subscriber acquisition expenses, and regulatory uncertainties are key factors to consider. A scenario analysis would explore different potential outcomes for FuboTV’s stock price under various market conditions.

- Bullish Scenario: Successful expansion into new markets, strong subscriber growth, and the achievement of profitability could lead to a significant increase in stock price.

- Neutral Scenario: Moderate subscriber growth, stable market share, and continued operating losses could result in a relatively flat stock price.

- Bearish Scenario: Increased competition, high churn rates, and failure to achieve profitability could lead to a substantial decline in stock price.

External factors, such as changes in consumer preferences, technological disruptions, and macroeconomic conditions, could significantly impact the future price of Fubo stock.

Top FAQs: Fubo Stock Price Prediction

What are the major risks associated with investing in FuboTV stock?

Investing in FuboTV stock carries inherent risks, including competition from established players, potential for continued financial losses, and regulatory uncertainty within the streaming industry. Market volatility and overall economic downturns could also negatively impact the stock price.

Predicting Fubo’s stock price involves analyzing various market factors and its competitive landscape. Understanding the performance of similar companies in the media sector is crucial, and a good starting point is checking the current 3m stock price, which you can find here: current 3m stock price. Comparing Fubo’s trajectory to 3M’s provides valuable context for assessing its potential future valuation and helps refine any Fubo stock price prediction.

How does FuboTV’s churn rate compare to its competitors?

A direct comparison requires detailed financial reports from FuboTV and its competitors. Churn rate is a key metric and publicly available financial reports should be consulted for accurate data.

What is FuboTV’s current market capitalization?

FuboTV’s market capitalization fluctuates constantly. Reliable real-time data should be sourced from reputable financial websites.

What are the key financial metrics to watch for FuboTV?

Key metrics include revenue growth, subscriber acquisition cost, average revenue per user (ARPU), churn rate, and overall profitability (or path to profitability).