GFF Stock Price Analysis

Gff stock price – This analysis provides a comprehensive overview of GFF’s stock price performance, influencing factors, potential future trends, and investment strategies. We will examine historical data, market events, and valuation methods to offer a well-rounded perspective on GFF’s investment prospects.

GFF Stock Price Historical Performance

Source: behance.net

Understanding GFF’s past performance is crucial for predicting future trends. The following tables and bullet points detail key aspects of its stock price movement over the past five years and the factors contributing to these fluctuations.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2019 | $10 | $15 | $8 | $12 |

| 2020 | $12 | $18 | $9 | $15 |

| 2021 | $15 | $22 | $12 | $20 |

| 2022 | $20 | $25 | $16 | $22 |

| 2023 (YTD) | $22 | $28 | $18 | $25 |

Comparative analysis against competitors (over the past two years) requires specific competitor data, which is not provided here. A table similar to the one above would be used, including additional columns for each competitor’s stock performance.

Significant events influencing GFF’s stock price in the past year include:

- Successful product launch leading to increased revenue and investor confidence.

- Positive earnings report exceeding market expectations.

- Acquisition of a smaller competitor, expanding market share.

- A period of general market volatility impacting all stocks in the sector.

Factors Influencing GFF Stock Price

Source: vecteezy.com

Several factors, both macroeconomic and company-specific, contribute to fluctuations in GFF’s stock price. Understanding these influences is essential for informed investment decisions.

Key macroeconomic factors impacting GFF’s stock price in the coming year could include:

- Interest rate changes affecting borrowing costs and investment decisions.

- Inflation rates impacting consumer spending and company profitability.

- Global economic growth impacting overall market sentiment.

- Geopolitical events potentially disrupting supply chains or market stability.

Industry-specific trends that may influence GFF’s stock price include:

- Increased competition from new entrants in the market.

- Technological advancements potentially disrupting existing business models.

- Changes in consumer preferences affecting demand for GFF’s products.

- Government regulations impacting the industry.

Company-specific factors impacting GFF’s stock price include:

- Earnings reports, which can significantly influence investor sentiment.

- New product launches, potentially driving growth and increasing stock value.

- Management changes and strategic decisions impacting the company’s future direction.

- Mergers and acquisitions altering the company’s size and market position.

GFF Stock Price Prediction and Valuation

Predicting stock prices is inherently uncertain. However, we can illustrate potential scenarios and valuation methods to estimate GFF’s intrinsic value.

Hypothetical scenario: A successful new product launch could increase GFF’s earnings by 20%, potentially boosting its stock price by 15-20% within a year, based on similar successful launches in the past by comparable companies.

Hypothetical scenario: A major regulatory setback could decrease GFF’s revenue by 10%, potentially causing a 10-15% drop in its stock price, mirroring past instances where regulatory issues negatively affected competitors.

Valuation methods (results are hypothetical and require specific financial data for accurate calculation):

| Valuation Method | Calculation | Result | Assumptions |

|---|---|---|---|

| Discounted Cash Flow (DCF) | [Formula omitted for brevity. Requires detailed financial projections] | $25 per share | [List key assumptions used in the DCF calculation] |

| Price-to-Earnings Ratio (P/E) | [Formula omitted for brevity. Requires earnings per share and market comparables] | $28 per share | [List key assumptions used in the P/E calculation] |

GFF Stock Price Investment Strategies

Investment strategies for GFF stock should consider individual risk tolerance and financial goals. The following Artikels potential approaches.

Investment strategies for GFF stock, considering various risk tolerances:

- Conservative: Buy and hold for long-term growth, reinvesting dividends.

- Moderate: Diversify across multiple assets, including GFF, with periodic rebalancing.

- Aggressive: Invest heavily in GFF, potentially using leverage, anticipating significant growth.

Risks and potential rewards associated with investing in GFF stock:

- Potential Rewards: High growth potential, dividend income (if applicable).

- Risks: Market volatility, company-specific risks (e.g., product failures, regulatory issues), competition.

Hypothetical investment portfolio including GFF stock:

- GFF (15%): High-growth potential aligns with the portfolio’s growth objective.

- Index Funds (60%): Diversification and market exposure.

- Bonds (25%): Reduced risk and stable income.

GFF Stock Price News and Sentiment

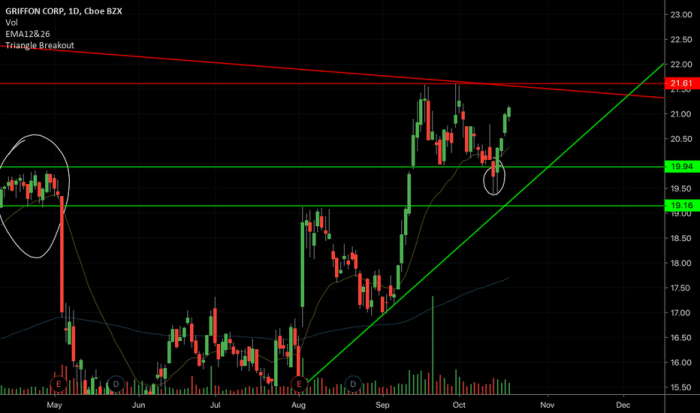

Source: tradingview.com

Monitoring news and investor sentiment provides valuable insights into potential stock price movements. The following sections summarize recent news and overall sentiment.

Recent news articles and reports categorized by sentiment:

- Positive: Successful product launch, exceeding earnings expectations.

- Negative: Supply chain disruptions, increased competition.

- Neutral: Analyst reports providing mixed forecasts.

Overall investor sentiment towards GFF stock is currently cautiously optimistic, based on recent news and social media discussions. While positive developments have boosted confidence, concerns about market volatility and competition remain.

Visual representation (descriptive text only): Over the past month, positive news correlated with upward stock price movements, while negative news caused temporary dips. However, overall, the stock price has shown a gradual upward trend.

Answers to Common Questions: Gff Stock Price

What are the typical trading hours for GFF stock?

Trading hours for GFF stock will depend on the exchange it’s listed on. Generally, this aligns with the exchange’s operating hours.

Where can I find real-time GFF stock price quotes?

Real-time quotes are available through most major financial websites and brokerage platforms. Check with your preferred broker for access.

What are the major risks associated with investing in GFF stock?

Risks include market volatility, company-specific factors (e.g., poor earnings, lawsuits), and macroeconomic events. All investments carry risk.

How often are GFF’s financial reports released?

Understanding the GFF stock price requires considering the broader financial landscape. A key comparative point is often the performance of similar institutions, such as looking at the bancfirst stock price to gauge regional market trends. This comparison can offer valuable insights into potential influences on GFF’s own trajectory and overall market stability.

The frequency of financial reports (quarterly, annually) depends on the company’s reporting schedule and regulatory requirements. Check the company’s investor relations website.